INDICATION that Nigeria’s economy is still in the throes of death has continued to emerge with the current low revenue it is generating from oil sale and increasing demands on its foreign debt obligation especially. The parlous state of the economy is heightened by the revelation that most of the revenue being made by the country is being expended on payment of interests on loans, leaving very little for development, just as it continues to look for more facilities from other external sources.

But curiously, Sunday Tribune investigation revealed that some of the loans are not tied to specific projects, except the ones facilitated by China. But the Minister of Information, Alhaji Lai Mohammed, on Saturday, said there is nothing wrong in the Federal Government in borrowing as long such loans are committed to building infrastructure rather than spending same on consumption and overheads.

Mohammed, who spoke at the construction site of Ibadan Train Station, said “We borrowed money for capital projects like rail, roads, bridges, power infrastructure generally,” he said. Earlier in November 2018, the International Monetary Fund (IMF) said Nigeria was spending more than 50 per cent of its revenues on servicing debts, thus blocking other necessary expenses.

However, by last month, the IMF sounded the alarm that the country would spend all 2020 revenue on paying interests on its debts. According to the medium-term expenditure framework and fiscal strategy (MTEF/FSP) report published by the Budget Office of the Federation (BoF), debt service to revenue ratio for the first quarter of 2020 was 99 per cent.

During the quarter, the Federal Government’s retained revenue was N950.56 billion while N943.12 billion was expended on debt servicing. While speaking at a House of Representative’s retreat on the 2021-2023 Medium Term Expenditure Framework and Fiscal Strategy Papers (MTEF/ FSP) on Thursday, Minister of Finance, Budget and National Planning, Zainab Ahmed, explained that by the end of half-year 2020, the Federal The government’s retained revenue was N1.81 trillion, while N1.57 trillion was spent on paying interest on debts.

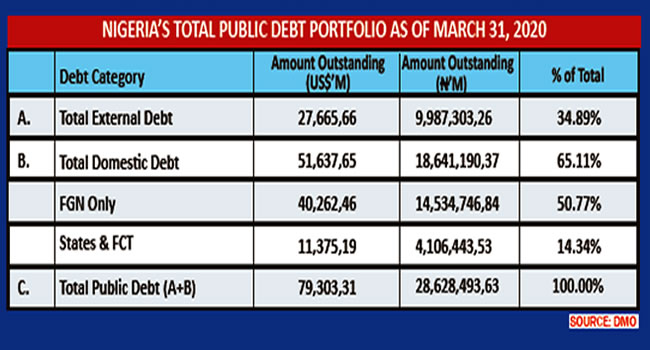

According to the Debt Management Office (DMO), Nigeria’s total public debt has continued to rise, increasing to $79.5 billion (N28.63 trillion) as of the first quarter of 2020, which ended on March 31, 2020, representing a 15 per cent ncrease from the corresponding period in 2019 of $69.09 billion (N24.94 trillion).

Out of this debt, $27.66 billion (N9.9 trillion) or 34.89 per cent of the total public debt stock was sourced externally, while the total domestic debt stands at $51.64 billion (N18.64 trillion), which represents 65.11 per cent of the total public debt.

A breakdown of the debt shows that the Federal Government accounts for 50.77 per cent of the total domestic debt, which is $40.26 billion (N14.53 trillion), whereas the state governments and Federal Capital Territory account for 14.34 per cent of the total domestic borrowing which is $11.37 billion (N4.11 trillion).

Interestingly, however, only the loans were taken from China are tied to specific projects. Explaining why the country stands at great risk, Jesmin Rahman, IMF’s mission chief and senior resident representative for Nigeria, attributed the country’s fiscal problems to low revenue, which accordingly is not enough for sustainable growth.

“The first vulnerability comes from having a very low level of fiscal revenues, total revenues at seven per cent of GDP is less than half of sub-Saharan Africa’s average and far lower than the averaging oil-exporting countries. “It is also lower than the the minimum threshold of 12 per cent which is considered necessary for the government to provide an enabling nd growth-enhancing role.

“Interest payments take up a large share of revenues, leaving little resources for everything else this year. In particular, all of the Federal Government’s revenues are expected to be spent on interest payments. “This is particularly staggering when we look at how littleis spent on education and health.”

Speaking further, Rahman said the IMF considers Nigeria’s public debt, including Asset Management Corporation of Nigeria’s debt (which stands at 29 per cent of GDP) lower than the 53 per cent average in other developing and emerging market economies.

“When we do our in-depth analysis, public debt is projected to reach about 37 per cent of GDP this year and remains roughly around that level in the medium term,” she said.

“We do various stress scenarios in our debt sustainability analysis and in all of those scenarios, public debt does not go beyond 50 per cent of GDP.

“So, I will not say that public debt is having a crisis or that public debt is extremely high. It is really a revenue issue; very low and volatile revenue is what poses a lot of fiscal risks and there are sizable financing risks in the next 12 months.”

Commending the 2019 Finance Act, the IMF official said Nigeria needs to move on multiple fronts to raise revenue beyond the minimum threshold necessary for government effectiveness. She listed some of the moves to include improving value-added tax and company income tax efficiency, increasing the percentage of active taxpayers, reducing tax exemptions and raising trust in public institutions to improve tax morale.

YOU SHOULD NOT MISS THESE HEADLINES FROM NIGERIAN TRIBUNE

Plan To Destabilise Nigeria Is Real — SSS

THE State Security Service (SSS), on Friday, insisted that there were plans by some unnamed notable personalities in the country to subvert the nation. In a statement made available to newsmen in Abuja by its spokesperson, Dr Peter Afunanaya, the service pointed out that part of the orchestrations of the plotters was to engage in divisive acts as well as use inciting statements to pit one group against another in the country…

More Heads To Roll In UNILAG •Babalakin, Ogundipe Trade Words, Resumption In Jeopardy

MORE top officials of the embattled University of Lagos (UNILAG) are to be axed for alleged financial recklessness and mismanagement which consumed the institution’s Vice-Chancellor, Professor Oluwatoyin Ogundipe on Wednesday, the Governing Council, disclosed on Friday…

INEC Seeks Stakeholders Collaboration In Instituting Electoral Transparency

The Independent National Electoral Commission (INEC) has urged stakeholders in the electoral process to join the commission in deepening the use of technology and instituting a regime of transparency in electoral process. INEC Chairman, Prof. Mahmood Yakubu, represented by Mr Festus Okoye, INEC National Commissioner and Chairman, Information and Voter Education Committee, made the call at a virtual…

How Bandits, Terrorists, Other Criminals Get Their Weapons —Retired Col. Majoyeogbe, Ex-Commandant, Army Intelligence School

Colonel Olanipekun Majoyeogbe retired from the Nigerian Army after holding various posts, including Commandant, Nigerian Army Intelligence School and Commandant, SSS Training School. In this interview by SUYI AYODELE, the graduate of English from the Obafemi Awolowo University (OAU), Ile Ife, speaks on various issues bordering on the Nigerian security situation…

National Assembly Acting Clerk Advocates E-Parliament

Acting Clerk to the National Assembly, Mr Olatunde Amos Ojo, has again restated his determination to transform the National Assembly “for better deliveries of constitutional responsibilities that is of international standard in lawmaking, representation and oversight…”