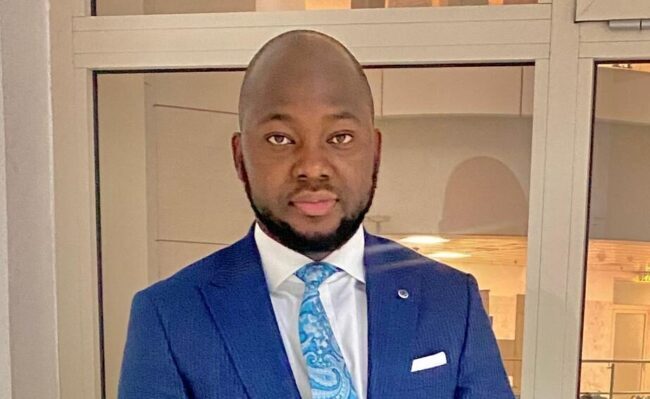

At an economic development forum in Lagos, financial expert Jacob Abu called on the government to incorporate financial literacy into the national education curriculum as a strategy for youth empowerment and economic growth. Speaking to an audience of policymakers, educators, and business leaders, Abu emphasised the need for early financial education to equip young Nigerians with the skills needed for wealth creation and economic self-sufficiency.

“The foundation of a strong economy begins with financial knowledge,” Abu stated. “If we educate our youth on the principles of savings, investments, and responsible money management, we are setting them on the path to financial independence and long-term economic stability.”

Abu highlighted that many young Nigerians enter adulthood without a clear understanding of financial planning, making them vulnerable to poor money management and limited economic opportunities. He stressed that integrating financial education into schools would help bridge this knowledge gap and prepare students for real-world financial responsibilities.

He also pointed out that financial literacy can promote entrepreneurship among young people, enabling them to start and sustain businesses. “When young individuals understand financial management, they are more likely to take calculated risks, invest wisely, and create employment opportunities for others,” Abu explained.

Abu recommended that the government collaborate with financial institutions, schools, and community organisations to develop comprehensive financial education programmes tailored to different age groups. He also urged policymakers to establish mentorship programmes where financial experts can guide young entrepreneurs on business development and investment strategies.

“We must create a financial ecosystem that supports learning, innovation, and entrepreneurship,” Abu said. “Financial literacy should not be a privilege for the few—it should be a fundamental part of our education system.”

To further support economic growth, Abu encouraged government agencies to invest in digital financial tools that can provide young people with easy access to banking, investment platforms, and business financing options. He believes that by leveraging technology, financial education can be more interactive and accessible to a wider audience.

Concluding his speech, Abu called for immediate action from stakeholders to integrate financial literacy into national policies and educational frameworks. “If we fail to act now, we will continue to see a cycle of economic hardship and dependency,” he warned. “But if we invest in financial knowledge today, we empower our youth to build a prosperous future for Nigeria.”

ALSO READ TOP STORIES FROM NIGERIAN TRIBUNE