Opening a bank account is essential for managing finances, but what happens if you don’t have the necessary documents to do so? In Nigeria, banks usually require you to provide your Bank Verification Number in order to access complete banking services.

However, not everyone has a BVN. So, how do you open a bank account without a BVN in Nigeria? The good news is that not having a BVN shouldn’t stop you from opening a bank account for your financial transactions.

Whether you’re looking for a temporary banking solution or a more permanent option, this guide provides step-by-step methods, such as using USSD codes or your National Identification Number (NIN) to open a personal bank account.

What is a BVN ( Bank Verification Number)?

Your Bank Verification Number(BVN) is an 11-digit number that banks use to identify you as a customer, and it is linked to your details such as name, contact number, address, etc.

The Central Bank of Nigeria introduced this concept of having a verification number for bank accounts on February 14, 2014, in collaboration with the Nigeria Inter-Bank Settlement System (NIBSS).

Its sole aim is to improve financial security through banking in the country by preventing financial crimes and fraud nationwide.

Whether you’re using a business or personal bank account for your financial transactions, you will need to provide a verification number such as your BVN.

But how about if you do not have a BVN and need to open a bank account? Let’s look at other options you can use to open a bank account in Nigeria, even without a BVN, including their advantages and limitations.

1. Bank USSD Codes

You can use a USSD code to open a bank account at most banks if you do not have a phone with internet access. It’s a flexible banking option that lets you perform necessary transactions such as transfers, airtime/data top-ups, and much more. To open a bank account using your USSD, follow these steps below;

- Dial the bank’s USSD code.

- Follow the instructions displayed on the screen by typing your name, phone number, and other required details.

- Once you’ve successfully imputed your details, you’ll receive an SMS notification containing your bank account details.

However, you should note that opening a bank account number using a USSD code has limitations. These can include transaction limits, and and not having access certain services on the banking platforms.

2. Using your NIN

You can easily open a bank account in Nigeria using your National Identification Number(NIN) rather than your BVN. This is convenient for those who have their national IDs but don’t have a BVN yet and wish to have either a business or personal bank account.

For instance, let’s look at the steps to open a bank account with Moniepoint MFB using just your NIN;

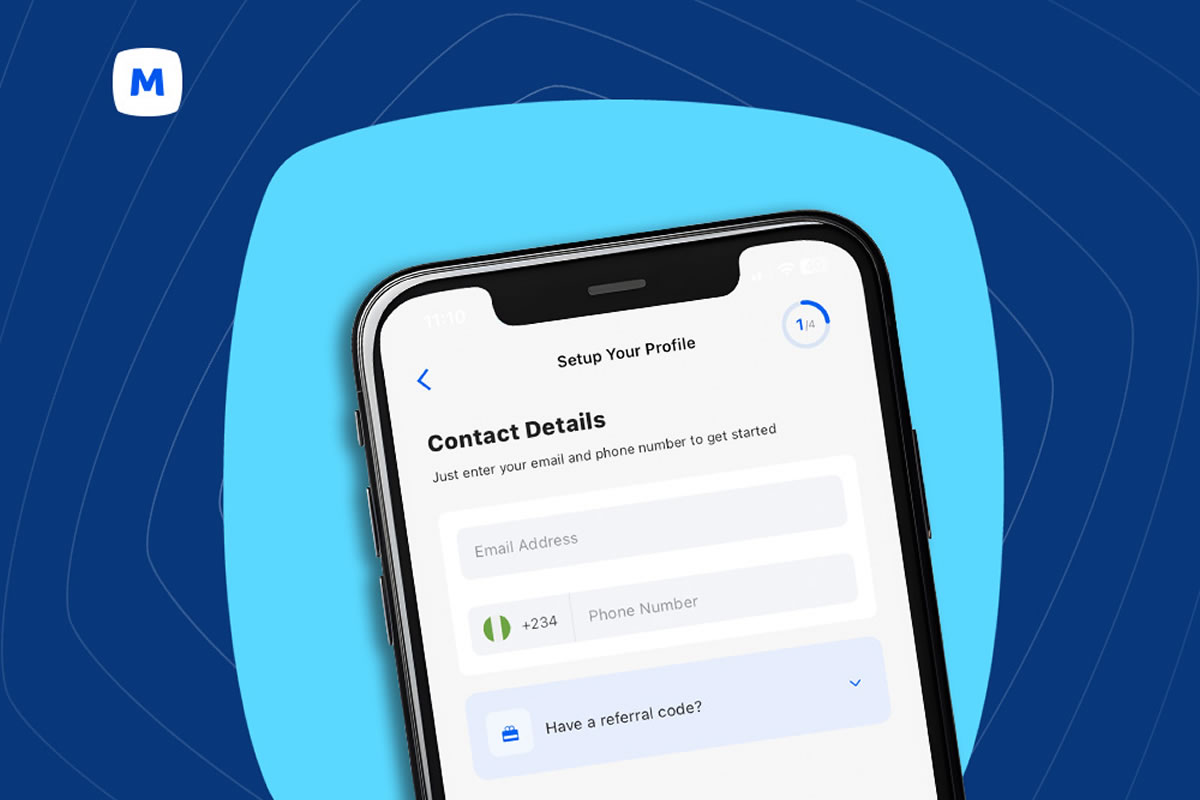

- Download the updated Moniepoint Business or Personal Banking application from the App Store or the Google Play Store.

- Sign up using your phone number or email address and set up your password and transaction pin.

- Log into your account and click “Proceed” on the “Create Account” section.

- You will see the requirements for upgrading to KYC level 1

- You will receive an option to select either the NIN or BVN verification. Choose NIN and click on “Next”.

- An NIN detail is displayed if your registered phone number links to it. If the details belong to you, click “Yes, it is”. If it doesn’t, click “No, it’s not”.

- If the displayed details do not belong to you, you can input your NIN and click “Next”. You can also dial the code *346# on your registered phone number for a network service fee of N20 if you can’t remember your NIN,

- You will be required to carry out a face verification to confirm if an actual person is opening the account and to verify that your picture matches that on your NIN database. You will be presented with prompts on the steps to follow. Click on “Proceed”. Properly position your face in the oval and smile for a camera capture.

- Once you confirm that the image is of good quality, click “Yes, use this” and “Continue” until you see the identity verified screen. Note that if your image does not match that on your NIN, you can retry verification.

- After this, you will be asked to provide other KYC level one upgrading verification, such as your residential address and attestation.

Pros and Cons of Opening a Bank Account Without a BVN or NIN in Nigeria

Opening a bank account in Nigeria without using a BVN has its advantages and limitations. Some of them include:

| Pros | Cons |

| ● It’s quick and easy to open a bank account even without an internet connection. | ● Your transaction limit will be very low, with a limit of just N50,000. |

| ● You can easily set it up without visiting the bank’s physical location. | ● You can’t access banking services like loans and other higher KYC tiers. |

| ● You can use it to set up bank accounts for temporary use or savings. | ● You won’t have access to a debit or ATM card. |

Conclusion

Everyone needs a functional bank account to operate in today’s business world, and thanks to technological advancements, you can easily open one regardless of location.

By using options like the USSD codes and NIN, you can easily create a bank account on the spot, even without a BVN.

WATCH TOP VIDEOS FROM NIGERIAN TRIBUNE TV

- Let’s Talk About SELF-AWARENESS

- Is Your Confidence Mistaken for Pride? Let’s talk about it

- Is Etiquette About Perfection…Or Just Not Being Rude?

- Top Psychologist Reveal 3 Signs You’re Struggling With Imposter Syndrome

- Do You Pick Up Work-Related Calls at Midnight or Never? Let’s Talk About Boundaries