DESPITE a balance of $3.2 billion Chinese loan outstanding, China is willing to fund the bulk of the estimated $2.8 billion Nigeria’ gas pipeline project, whereas the country is seeking $1 billion from the Asian tiger so work can continue on the pipeline.

However, Reuters reported that China has developed cold feet after they pledged to offer most of the funds, which Nigeria is sceptical about taking.

As of March 2021, Nigeria had borrowed $3.7 billion from China, out of which it had paid back about $500 million, leaving a balance of $3.2 billion.

It is the latest sign of falling Chinese financial support for infrastructure projects across Africa, after years of major Chinese lending for railway, energy and other projects.

A spokesman for state oil company (NNPC), which is building the 614-km (384-mile) Ajaokuta-Kaduna-Kano (AKK) pipeline, said it was still negotiating with the Chinese lenders – Bank of China and Sinosure – to cover $1.8 billion of the project cost.

“There’s no cause for alarm,” the spokesman said, without saying whether NNPC was turning to other lenders.

But Reuters quoted three sources as having said that the company was now approaching others, including export-import institutions, to continue work on the pipeline that will run through the middle of the West African country to its northern economic hub, Kano.

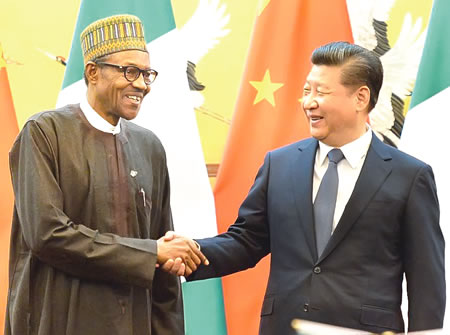

Chinese lenders had originally been lined up to fund the bulk of the estimated $2.5 billion to $2.8 billion cost of the project, which is central to President Muhammadu Buhari’s plan to develop gas resources and boost development in northern Nigeria.

NNPC, which was funding 15 per cent, said last year it had used its own funds to start construction.

The sources said the Chinese lenders would not agree to disburse the cash NNPC had expected by the end of the summer, prompting it to turn to others.

“They are looking at Nigeria as one loan, and right now, they feel they are too exposed,” one source said

Bank of China said it would not comment on specific deals. Sinosure did not respond to a request for comment.

According to Reuters, the Nigerian ministries of transport, finance and petroleum also did not reply to requests for comment.

Chinese bank lending to African infrastructure projects has fallen across the continent, from $11 billion in 2017 to $3.3 billion in 2020, a Baker McKenzie report said in April.

Analysts say with the continent facing an estimated annual $100 billion infrastructure investment deficit, the loss of Chinese funding leaves a big gap to fill.

Nigeria began building the AKK pipeline in June 2020, saying it would help generate 3.6 gigawatts of power and support gas-based industries along the route.

The project was to be funded under a debt-equity financing model, backed by sovereign guarantee and repaid through the pipeline transmission tariff.

NNPC awarded engineering and construction work along three sections of the pipeline to Oando, OilServe, China First Highway Engineering Company, Brentex Petroleum Services and China Petroleum Pipeline Bureau.

Transportation Minister, Rotimi Amaechi said this month Nigeria was negotiating a mix of loans from Chinese and European lenders to fund railway projects, after media reports.

This was after reports Nigeria had initially planned to rely primarily on Chinese banks.

As of March 2021, Nigeria had borrowed $3.7 billion from China, out of which it had paid back about $500 million, leaving a balance of $3.2 billion.

It is not only the AKK gas project that China has developed cold legs in funding.

It is also holding its funds from going to Nigerian ICT Infrastructure Backbone project phase 2.

The project in 2018 was to cost $2.3 billion, with China fully funding it.

But till now, no dime has been disbursed, three years after.

China loans only make up 10 per cent of Nigeria’s total indebtedness estimated at $32 billion by the Debt Management Agency.

The World Bank, IMF and development banks account for 54.7 per cent of the debt. Bilateral loans, including from China, are about 12.4 per cent.

Euro and Diaspora bonds are about 24 per cent.

Meanwhile, the Federal Government has lashed out at some Nigerians critical of the Buhari administration’s penchant for foreign loans, assuring that the government has not signed away the nation’s sovereignty in loan commitment to China.

Speaking in Abuja last week, Minister of Works and Housing, Mr Babatunde Fashola, said that the government has always budgeted for its counterpart funding for most of the contracts it has with China.

YOU SHOULD NOT MISS THESE HEADLINES FROM NIGERIAN TRIBUNE

We Have Not Had Water Supply In Months ― Abeokuta Residents

In spite of the huge investment in the water sector by the government and international organisations, water scarcity has grown to become a perennial nightmare for residents of Abeokuta, the Ogun State capital. This report x-rays the lives and experiences of residents in getting clean, potable and affordable water amidst the surge of COVID-19 cases in the state…

Selfies, video calls and Chinese documentaries: The things you’ll meet onboard Lagos-Ibadan train

The Lagos-Ibadan railway was inaugurated recently for a full paid operation by the Nigerian Railway Corporation after about a year of free test-run. Our reporter joined the train to and fro Lagos from Ibadan and tells his experience in this report…

WATCH TOP VIDEOS FROM NIGERIAN TRIBUNE TV

- Relationship Hangout: Public vs Private Proposals – Which Truly Wins in Love?

- “No” Is a Complete Sentence: Why You Should Stop Feeling Guilty

- Relationship Hangout: Friendship Talk 2025 – How to Be a Good Friend & Big Questions on Friendship

- Police Overpower Armed Robbers in Ibadan After Fierce Struggle