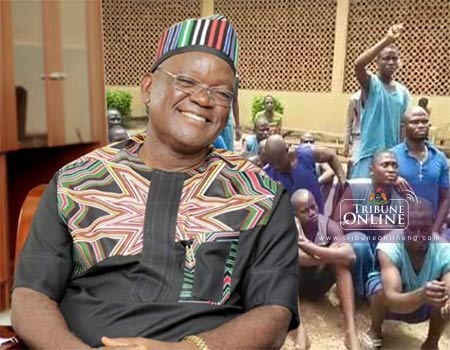

BENUE state governor, Samuel Ortom has shed light to how the state was able to recover the N4.5 billion bonds that had generated controversy between his government and the erstwhile governor of the state, Gabriel Suswam.

Ortom disclosed this to newsmen at the weekend.

The governor said that the transaction between the bank and his predecessor was anchored on falsehood and lies, the situation which he said promoted his administration to petition the Security and Exchange Commission which investigated the matter and resolved that the bonds be refunded to the state government.

He, however, added that the overdraft the immediate past administration had procured to service the bonds has become a liability to his government which he said would be paid within the period of four years.

The N4.5 billion bonds had generated controversy between governor Ortom and his predecessor, Dr Gabriel Suswam.

Ortom had accused Suswam of collecting the N4.5 billion bond meant for specific projects and diverted it to his personal use, while the latter had exonerated himself of complicity in the said bonds.

The erstwhile governor had stated that he never received any bond from the stated bank, United Bank of Africa, UBA and could not have diverted the money not released to him.

The governor who acknowledged the payment of the money to the state’s coffer last week told newsmen that the bank had planned to use the fund to service the overdraft of N4.5 billion earlier obtained by his predecessor.

Ortom said, “The whole process was anchored on falsehood and lies, bonds are meant for specific projects and in this case, they were meant for 13 projects; Daudu/Gbajimba Road, Oshigbudu to Obagaji Road, Tarka /Honor, Zakibiam/Afia, Oju Obusa Utonkon Road, water projects in Otukpo and Katsina Ala. All together about 13 projects.

“And when this money came, instead of channelling this money to the specific projects that this bond was approved for, It was rather used for serving overdraft of N4.5 billion.

“That was why we have issues. So we engaged a consultant who approached Security and Exchange Commission (SEC) and wrote a petition and SEC did an investigations and decided that this money should go back to the original use.

“That is what had been accredited to our account. So we can go ahead and complete these projects that originally these bond was collected for.

“Now the issue of overdraft and those documents that were written which was used to access the overdraft was forged by past administration. That is where we are having a case with them because there was no Exco on the day purportedly to get the extract given to the bank that they directed that the money should be given to them.

“There was no exco but minutes were generated. Of course, not just minutes but extracts. It was packaged and all those documents written to the bank on this matter were not in the file and all the reference numbers were forged. So, this is where we have case.”

“We do not have the resources to talk of paying the overdraft within one month or 60 days as the case may be so we have to restructure. And we have agreed with the bank that we will restructure the overdraft to a period of four years which is about N136m a month,” Ortom concluded.