Despite reasons given by the Central Bank of Nigeria (CBN) and the Nigeria Deposit Corporation (NDIC), for intervening in Skye Bank, there seems to be a general feeling among sections of stakeholders that all have not been heard about the misfortunes of a lender which not too long ago, prides itself as one of the biggest banks in Nigeria.

This has created room for a lot of speculations as to the real reason and those behind Skye Banks failure.

To some, highly privileged individuals deliberately pulled the rug out from under the bank to package it for sale to their allies. To others, it was an error of judgment by past management of the bridge bank called Mainstreet Bank that crippled Skye Bank. Yet, to another set of analysts, the challenge Skye Bank faced started from downturn in the Nigerian economy which led to its unimpressive performance as evident in its 2015 financial statements.

According to the last group, the poor outing was as a result of high loan impairment charges due to aggressive loan growth combined with negative macroeconomic trends that have negatively affected its loan books as businesses in oil and gas, power, telecommunications, manufacturing and financial services face serious short-term challenges.

Skeptics are not satisfied with CBN’s explanations. The CBN has explained that there was unacceptable corporate governance lapses as well as persistent failure of Skye Bank Plc to meet minimum thresholds in critical prudential and adequacy ratios, which culminated in the bank’s permanent presence at the CBN Lending Window, those pathetic to the ordeal of Skye Bank still want to know what steps the management took that were now regarded as “unacceptable corporate governance lapses.” Perhaps, this will be more convincing, as the genesis of Skye’s problem.

It is on this premise that the Nigerian Tribune carried out investigation into the ordeal of Skye Bank. Publicly available materials from the CBN, Nigerian Stock Exchange (NSE) and interviews with those who played important roles revealed that the signs of downfall were glaring but probably not taken seriously by those who should.

Also, extracts were made from a Twitter tread by Yinka Ogunnubi, a public sector analyst and author of “Horney is in the budget.”

First, Nigerian Tribune tracked down for interview the man at the helm of affair at AMCON when Mainstreet Bank was sold. In an exclusive interview on the first business day after the birth of Polaris Bank, Mustapher Chike-Obi still sounded the way regulators sounded. According to him, the general economic condition in Nigeria and tight monetary policy were the initial problems that finally led to the withdrawal of Skye Bank’s license.

The man who packaged the sale of Mainstreet Bank to Skye, told Nigerian Tribune that contrary to the belief in certain quarters that Skye Bank’s problems started with the acquisition of defunct Mainstreet Bank, the lender only paid N126 billion which is far lower than N786 billion CBN has just recapitalised it with, so one cannot say that it was because the lender bought Mainstreet bank that it went into liquidity problems.

Even if the money was returned to Skye Bank, Chike-Obi argued, it would not have solved the problem. At worst he added, that could be 10 per cent of the problem.

“People said the problem was caused by insider abuse that created huge bad loans. All of that are exaggerated because even if you add up all the so called bad loans, it does not exceed N100 billion. Maybe they are contributory factors.

“I think the heart of the problem was that the economy of Nigeria went into a very difficult phase. There was a recession and weak recovery still going on. The combination of having to contend with high foreign exchange rate, high interest rate, tight monetary policy, weak economy and recession contributed to the problem. The former AMCON MD went on to say that, even in the United States, there are banks that are focused on consumer lending. Others are focused on corporate lending, government securities among others. The same thing applies to companies whereby they focus on different sectors of the economy, he explained.

“There were banks that focused on mortgage in the US. So, when there was mortgage problem, those banks went under. So, it is just that the sectors which Skye Bank was focused on, got hit hard by the economy,” Chike-Obi stated. Not satisfied, Nigerian Tribune went back into history in what researchers call desk research.

Skye Bank before the acquisition of Mainstreet

Looking back from 2005, Skye Bank was the product of the merger of five banks namely; Prudent Bank, EIB, Bond Bank, Reliance Bank and Cooperative Bank. It was listed on the NSE in November of the same year.

In August 2009, the CBN recapitalised five banks (including Afribank) to the tune of N620 billion on the back of huge Non Performing Loans said to be over 40per cent. All five banks were below the minimum capital adequacy ratio.

In 2011, after the failed attempt at recapitalising Afribank, the CBN announced its nationalisation and handed it over to the AMCON to manage through a capital injection program. Afribank was renamed Mainstreet Bank Limited (MBL) otherwise known as a “Bridge Bank.”

A bridge bank, according to financial experts, is a bank created by a central bank to take all assets and liabilities and operate a failed bank until a buyer can be found for its operations. Thus through an aggressive debt management program, AMCON was the vehicle used to grow Mainstreet (formerly Afribank) back to financial stability.

In 2014, AMCON announced that it was taking bids for sale of 100 per cent of its stake in MBL. Skye Bank emerged the preferred bidder with a bid of N126 billion. It paid the initial 20 per cent deposit (N26 billion) and on October 31, paid the balance of N100 billion ahead of the November 3, deadline to acquire MBL. Skye Bank emerged as one of the eight systematically important banks in Nigeria because of their size, complexity and systemic interconnectedness. They must not be allowed to fail because if they do, they would cause significant disruption to the entire financial system. In other words, they are “too big to fail.”

According to the bank, its interest in acquiring Mainstreet was to achieve an inorganic growth and address structural concerns in its preferred area of commercial banking business”. It said MBL has low NPL ratio of 4.3 per cent and has brand loyalty as well as wide branch network in the South-South and South-East of the country.

ALSO READ: Polaris Bank: CBN did not license nonregistered company, NDIC clarifies

Balance sheet position

Financial experts describe balance sheet as a statement of the financial position of a business which states the assets, liabilities, and owners’ equity at a particular point in time. It illustrates a true net worth of a business.

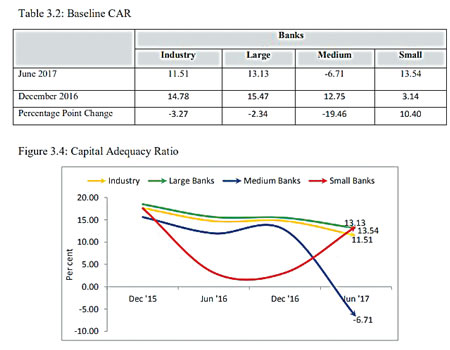

In 2014, there were warning signs. One of which was the rapidly reducing capital adequacy ratio of the bank. This issue was acknowledged by the CBN itself. However these concerns didn’t stop the CBN from giving its “no objection” to the deal.

The Capital Adequacy Ratio (CAR) is basically the proportion of the bank’s tier 1 & tier 2 equity (qualifying capital) as a proportion of its risk weighted assets (loans). It is the proportion of a bank’s equity in relation to its exposure.

In the case of Tier 1 and Tier 2 Capital, the first is made up of share capital, premium and reserves while Tier 2 is made up of other qualifying capital part of which could be debt.

The CBN in its wisdom set the CAR for regional banks at 10 per cent while national and international banks were set at 15 per cent. For systematically important banks the CAR was set at 15 per cent plus an additional capital surcharge of one per cent making it 16 per cent.

At the time of acquisition of MBL, the CAR of Skye Bank was 11 per cent (from 20 per cent in 2013). This was one per cent higher than minimum requirement for regional lenders and lower than their ranking as an SIB. By the time of integration of Skye Bank and the acquired bridge bank in June 2015, the CAR had fallen to 7.7 per cent way below regulatory standard.

So, at the time of bidding in 2014, the net asset of MBL was N69 billion but Skye Bank, however, bid N126 billion for it. This shows that the purchase consideration paid by Skye Bank was well above the net asset of MBL by about N59 billion.

This raised a lot of eyebrows because at the time, market capitalisation for Skye Bank was less than N40 billion while Tier 1 and Tier 2 capital was not sufficient to support the bid. Going by its financials as of December 2013, Skye Bank only had N26 billion of Tier 1 capital to fund acquisition.

This means it needed to raise additional N100 billion to be able to buy MBL.

Intrigues behind the deal

Surprisingly, the professional advisers engaged by AMCON approved Skye Bank as the preferred bidder. After all, their job according to stakeholders was to find a bidder.

Chike-Obi had earlier said the financial advisers’ job was to assess the bridge banks’ worth, value them and give advise which must be for the best interests of the financial sector. “We must make sure that whoever takes over these banks, ultimately, is fit and proper to run a bank. We must know where their money is coming from and we must know that the management is going to be sound. So, those are the three things that we want to consider,” he had said in an interview then. So, it was CBN’s job to approve “considering the interest of the financial system.”

In October 2014, CBN wrote a letter to Skye Bank communicating its “No Objection” to its selection as the Preferred Bidder. The CBN’s letter also acknowledged – the poor capital adequacy level of Skye Bank, but went ahead to approve the acquisition.

The letter reiterated that fresh funds should not be borrowed from the banking system in line with existing regulation prohibiting such borrowing to recapitalise banks.

The assumption typically was that capital could be used in acquisition but it must stay within CAR otherwise the regulator will not approve. In the case of Skye Bank their capital could only pay for the 20 per cent deposit while the options to pay the balance of N100 billion were to raise equity or debt.

The problem then was that if they decided to raise equity, they would face time constraints for processing the necessary approvals from shareholders, CBN, SEC and NSE, which would prevent them from meeting deadline to pay the balance. If they decided to raise debt, there was the regulatory constraint that caps tier 2 capitals at a max of 33 per cent of tier 1 capital. Since they already raised N30 billion through a commercial paper programme, there was little room left.

So, it obtained a bridge financing of N100 billion from four banks. The bridge financing was reportedly backed by AMCON Bonds in Mainstreet Bank that were due for redemption shortly after the closing of the transaction.

This perhaps could be why Chike-Obi told Nigerian Tribune that “one cannot say that it was because the lender bought Mainstreet Bank that it went into liquidity problems,” because “even if the money was returned to Skye Bank, it would not have solved the problem.”

Skye Bank paid the balance for the purchase of MBL on the 31st of October 2014 before the AMCON bond redemption maturity on November 3. Stakeholders wondered whether this was a coincidence or a deliberate plan factored into the purchase consideration in bidding N126 billion for MBL.

According to Ogunnubi, it is on record that as at November 3, 2014 MBL confirmed the receipt of N121 billion from AMCON being the AMCON bond redemption. This was the amount in the pot of MBL as at the time Skye Bank acquired it, it was now left for Skye to justify the N126 billion paid for the acquisition of MBL.

After the deal, by 2015, following the acquisition, indicators coming out from Skye Bank showed clearly that something wasn’t right. Loan-to-deposit ratio is the ratio of how much a bank lends out of depositors’ funds with it. (A higher ratio indicates a bank has given out more deposits as loan and vice versa). So, apart from falling below regulatory standard in terms of Capital Adequacy (7.7 per cent) and loan to deposit of 92 per cent in 2015, interbank peer comparison showed that Skye Bank was the only bank that made a loss (N40 billion) and had a negative profitability ratio. In fact between June 2014 when it bidded for MBL and December 2015 when it had completed six months post integration, it had lost 55 per cent of its share value. After the acquisition, Skye Bank was significantly oversized in terms of branches and personnel, compared to industry standards and was incurring huge expenditure in keeping its size. This compounded the bank’s negative capital position.

In October of 2015, the House of Representatives ordered the investigation of the sale of some banks by AMCON. One of those banks was Mainstreet Bank. The Adhoc committee raised several issues among which were that the MBL Headquarters in Lagos was among the list of property schedule of Mainstreet warehoused by the CBN but that the property was transferred to an individual and Skye Bank as the purchaser of MBL now became a tenant.

By 2016, things took a turn for the worse. Treasury Single Account (TSA), came calling. Skye Bank was heavily dependent on public sector funds. It lost N125 billion to TSA alone, adding to the N126 billion of its own money used to acquire the bank and several other payments tied to the same.

All these put together, Skye Bank’s liquidity ratio stood at eight per cent as opposed to the regulatory minimum of 30 per cent; CAR 10.48 per cent vs. 16 per cent (for SIBs); Loan to Deposit Ratio had risen to 98 per cent vs recommendation ratio of 80 per cent.

By March 2016, Skye Bank requested for a four-week extension to file its 2015 Audited report and at the same period, it was unable to release its Q4’15 & Q1’16 earnings reports, long after the expiration of the extension of the grace period, without any rational reasons for the delay. The market was getting restless and analysts were issuing sell recommendations on its shares.

CBN’s life support

Perhaps to right the wrongs of the past when it gave “no objection” approval to the Mainstreet Bank deal, the CBN in July 2016 sacked the board of Skye Bank and took control of the management. In reality the CBN had little option. It charged the new board to stabilise the bank, achieve the mandatory key regulatory ratio requirements, turn around and return the bank to profitability and improve the quality of its risk assets. The CBN injected over N350 billion into Skye Bank and gave it a waiver on Cash Reserve Requirement (CRR) for two years. The SEC and NSE were also assisting too. For one, it retained its listing status despite not submitting its 2016 report and Q1/Q2 in 2017 as well, all to help the new board meet its mandate. Fast-forward to September 2018, the CBN while announcing the revocation of Skye Bank’s license retained the board, management and staff for helping save depositors’ funds and restoring confidence on the bank.

The major task of the new board was first to stop the bleeding by getting the CBN to guarantee all deposits. The CBN take-over had resulted in a run on the bank and deposits level fell by over 23 per cent from N1.08 trillion to N829 Billion between July 2016 and March 2017.

The new board’s shocking revelations

The new board also engaged the services of two professional accountancy firms – PwC & KPMG to handle routine audit, forensic audit and review of banking operations. These engagements revealed a lot more. Skye Bank had a negative capital position of N690 billion as at December 2016. This was caused mainly by impairment of loans (a loan is considered to be impaired when it is probable that not all of the related principal and interest payments will be collected) to the tune of N529 billion and transactions in suspense to the tune of N280 billion, (relating to balance sheet and profit and loss manipulations from 2006 to 2016 as well as direct fraudulent cash withdrawals by known individuals).

The Forensic Audit further revealed that the bank operated two sets of books and this was responsible for the regulators/auditors inability to detect massive losses and infractions, particularly the balance of N280billion in suspense account. A suspense account is used as a place to temporarily hold unclassified or disputed funds and expenses while a company decides where to put them.

Role of insider-related loans

Further checks by Nigerian Tribune revealed that there were a lot of loans given out without adherence to credit lending criteria, especially the 5Cs of lending: Character, Capital (solvency) Capacity (cashflow), Conditions and Collateral. There are other debtors but four individuals / entities accounted for over N446 billion of insider related loans drawn from Skye Bank.

Conclusion

Despite the CBN’s best intentions, the liquidity ratio of Skye Bank didn’t improve. It fell short of the regulatory standard. The bank found it difficult to do normal banking business as it was shut out of the lucrative Foreign Exchange market and it had to deal with loads of litigations.

The CBN announced it was further injecting N786 Billion into the bank bringing it to a total of N1.476 trillion committed to rescuing this Systematically Important “too big to fail” bank.