The House of Representatives on Wednesday resolved to investigate the accumulation of debts by the Asset Management Corporation of Nigeria (AMCON) worth N5.4 trillion over the years.

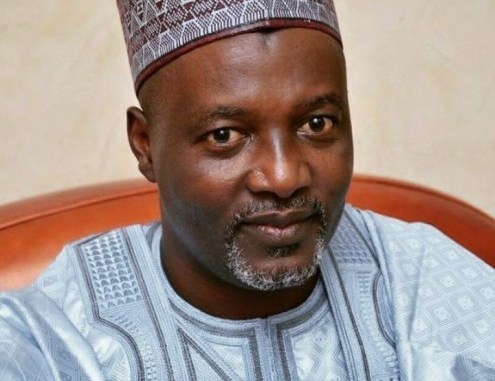

The resolution followed the adoption of a motion sponsored by Hon. Cornelius Nnaedozie Nnaji at the Plenary presided over by the Deputy Speaker, Hon Idris Wase.

The lawmakers who accused AMCON management of flouting the provisions of the AMCON establishment Act alleged that the debt profile was in excess of its N800 billion debt ceiling.

In his lead debate, Hon. Nnaji observed that AMCON was established in 2015 to among other functions, acquire eligible bank assets from eligible financial institutions and to hold, manage, realize and dispose of eligible bank assets (including the collection of interest, principal and capital due and taking over of collateral securing such assets).

He, however, lamented that AMCON is “currently challenged by difficulties in recovery of debts owed by debtors to the tune of N5.4 trillion.”

According to him, “the House is aware that AMCON claims that 20 individuals/entities are responsible for about 67 per cent of the N5.4 trillion debt portfolio of the corporation, an amount which is over 50 per cent of the 2018 budget of Nigeria.”

ALSO READ: LAUTECH: ASUU threatens to disrupt academic activities over unpaid salaries

He further alleged that “some of the debtors who owed large portions of the debts are alleged to be unwilling to pay.”

While ruling, Deputy Speaker of the House of Representatives, Hon Ahmed Wase who presided over the plenary session mandated the joint Committee on Banking and Currency and Insurance to investigate the debt portfolio of N5.4 trillion to AMCON and the alleged unwillingness of some of the debtors to pay.

The Joint committee is also expected to evaluate the status of the debts and the practical, legal and other strategies for the recovery of the debts, including recommending a time frame, and other options such as amendment of the AMCON Act, and report back within three weeks for further legislative action.