Gold has always been a prized asset for investors, serving as a store of value during times of economic uncertainty. Today, gold is breaking new highs and maintaining a strong upward trend. This is making gold trading more attractive than ever, particularly for those looking to take advantage of price fluctuations in the short term. With platforms like NordFX, trading gold is not only accessible but also packed with features that make the process smooth and efficient.

Overview of the Current Gold Market Situation

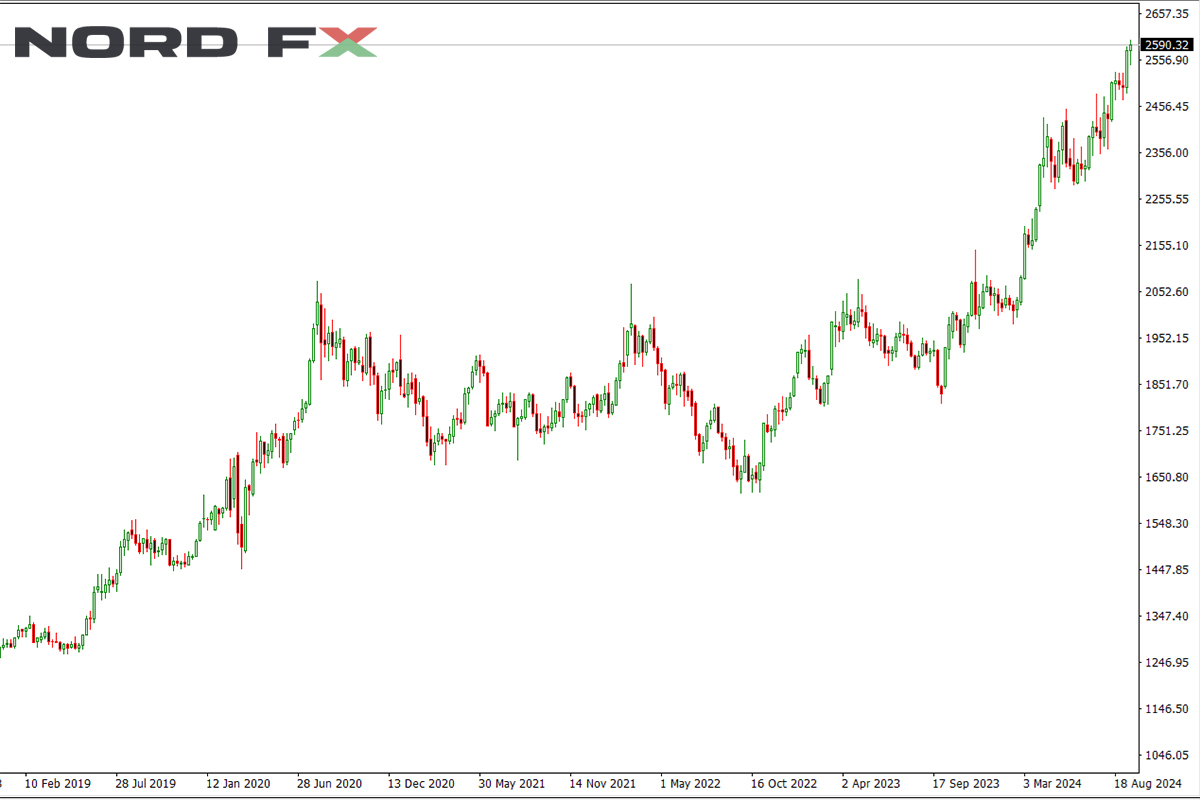

Gold prices have been on a remarkable upward trajectory, driven by a combination of economic uncertainty, inflation, and geopolitical tensions. As of 2024, gold is pushing toward new all-time highs, surpassing previous records set in recent years. For instance, in early 2020, gold prices spiked due to the COVID-19 pandemic, reaching levels not seen since 2011. Fast forward to today, and the price is still climbing, spurred by a weakening dollar, rising inflation, and ongoing geopolitical instability.

In this climate, gold has become a beacon for both seasoned investors and newcomers to the market, offering opportunities for both short-term profits and long-term wealth preservation. This makes it an ideal asset for trading, as the price fluctuations provide ample room for profit.

What Influences Gold Prices?

Several factors influence the price of gold, and understanding these is crucial for anyone looking to trade gold successfully.

Inflation and Economic Data: Gold often acts as a hedge against inflation. When inflation rises, the value of paper currency typically declines, leading investors to turn to gold to preserve their wealth. Economic data such as inflation reports, employment numbers, and GDP growth are key drivers of gold prices.

Interest Rates: Gold is a non-yielding asset, which means it doesn’t pay interest or dividends. Therefore, when interest rates rise, gold becomes less attractive compared to assets like bonds. Conversely, when interest rates are low, as they have been in recent years, gold becomes a more attractive option for investors.

Geopolitical Tensions: Uncertainty in the global political environment, such as conflicts or trade disputes, tends to drive investors toward gold. Gold is considered a “safe-haven” asset, and during times of global unrest, demand for it increases, pushing prices higher.

Currency Movements: Gold is priced in U.S. dollars, so fluctuations in the value of the dollar directly impact gold prices. When the dollar weakens, gold becomes cheaper for investors holding other currencies, increasing demand and pushing prices higher.

By understanding these factors, traders can make more informed decisions about when to enter or exit the gold market.

Why Now Is a Good Time to Trade Gold

Given the current economic environment, now may be one of the best times to trade gold. Here’s why:

Inflation Concerns: Inflation is a key driver behind gold’s recent price surge. As inflation rates continue to rise globally, investors are increasingly looking for assets that can preserve their purchasing power. Gold, being historically resilient to inflation, has emerged as a preferred asset for many.

Geopolitical Instability: Ongoing geopolitical tensions, such as trade disputes and conflicts in various regions, are creating a climate of uncertainty. In these conditions, many investors flock to gold to hedge against potential risks in the global financial system.

Weaker Dollar: The U.S. dollar has experienced fluctuations, and as the dollar weakens, gold becomes mor attractive for foreign investors. This dynamic is likely to continue, providing more opportunities for traders.

Market Volatility: The volatility in the stock and bond markets has also driven demand for gold. As other markets fluctuate, gold’s relative stability offers a safe haven for investors. For traders, this volatility in the broader market translates into opportunities to profit from short-term price movements in gold.

These factors combine to create a favorable environment for gold trading, making it an excellent time for traders to capitalize on market trends.

How to Trade Gold with NordFX

Now that we’ve established why it’s a good time to trade gold, let’s walk through how you can do it with NordFX.

Step 1: Open a NordFX Account

Before you can start trading gold, you’ll need to open a trading account with NordFX. The process is straightforward and involves a few simple steps. You can choose from different account types, depending on your trading style and experience level.

Step 2: Download MT4 or MT5

The next step is to download the trading platform that will allow you to access the market. NordFX supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular and powerful trading platforms in the world. Here’s how to get started:

Download MT4: Ideal for traders who prefer simplicity and reliability, MT4 offers all the essential tools for gold trading, including real-time price charts, technical analysis tools, and the ability to execute trades with just a few clicks.

Download MT5: For those seeking more advanced features, MT5 provides a broader range of order types, enhanced charting tools, and access to more markets. It is perfect for traders who want to diversify their portfolio beyond gold and explore other asset classes.

Step 3: Fund Your Account

After registration, you’ll need to fund your account using one of the many available deposit options. NordFX supports multiple currencies and payment methods, making it easy for you to get started with trading.

Step 4: Select the XAU/USD Trading Pair

The most common way to trade gold is through the XAU/USD pair, which tracks the price of gold relative to the U.S. dollar. On the NordFX platform, you can easily select this pair for trading. If you’re new to trading gold, check out this detailed guide on what is XAU/USD for a comprehensive understanding of this popular asset.

Step 5: Analyze the Market

Before placing a trade, it’s important to analyze market conditions. This can be done using both technical analysis (studying price charts and indicators) and fundamental analysis (considering economic news and events). On NordFX, you can access a wide range of tools and indicators to aid your analysis.

Step 6: Place Your Trade

Once you’ve analyzed the market, decide whether you expect the price of gold to rise (go long) or fall (go short). NordFX allows you to take either position depending on your market outlook.

Step 7: Monitor and Manage Your Trade

As with any form of trading, it’s important to manage your risk. On NordFX, you can use stop-loss and take-profit orders to automatically close your trade when certain price levels are reached, helping you protect your profits and minimize losses.

Gold trading presents unique opportunities, particularly in today’s economic climate, where rising inflation, geopolitical tensions, and market volatility create the perfect environment for price fluctuations. With gold consistently hitting new highs, now is a great time to consider adding it to your trading portfolio.