You might be rolling your eyes, but the question is worth exploring. Buying a used car may not have the luxurious feel of buying new, but it can save you thousands in the long run.

A used car is a popular choice for cost-conscious buyers, but many people are unsure about the wise move to purchase one. You might be wondering if financing a used car is a good idea at all.

We’ve taken the time to answer this vital question for you and figure out what you need to know before taking on this big responsibility.

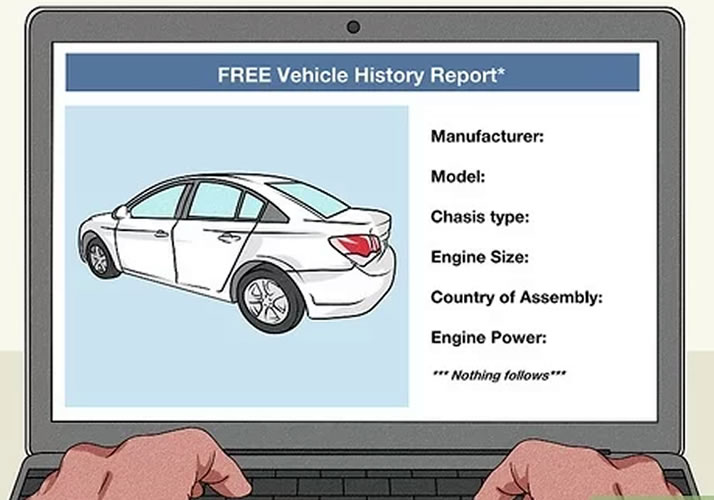

If you are going to buy a used car, know the car’s history. One of the most important reasons for getting a revs check of a used car is that it can prevent you from getting into a car that has been involved in an accident. That’s not all though-a Revs check report may give other important clues about whether or not your new purchase is good value for money.

Probably the most important thing to be aware of is that the report will let you know whether or not the car has been stolen. This could help you avoid being ripped off on a stolen vehicle. Even if you do get a good deal from someone who acquires and resells a stolen vehicle, you’re never going to be able to register it legally.

Financing a used car may be a good idea because you are able to get yourself the car of your dreams at an affordable price with a manageable monthly payment.

If we think about various factors, financing a used car is not always the best option. Do not finance a used car due to the following reasons:

1) Higher Overall Cost

If you purchase a used car with financing, it will take longer to pay off. This is because the interest rate will be higher than if you were to purchase without financing. So, even though you’ll receive more value for your money with a used vehicle, it may not be long before the loan is paid off.

2) Less Negotiation Leverage

When you purchase a car in cash, you have more leverage to negotiate than if you financed the vehicle. They can finance it for someone else in a matter of minutes and earn more money off of the transaction. This is because people are more likely to buy a car if they don’t have to pull money out of their bank account at once.

3) Risk Involved

When you finance a used car, the issuing lender owns it until you pay it off. Ultimately, this means that it’s their decision about what happens to your vehicle, regardless of how carefully you took care of it. They could repossess the car if you don’t make your payments.

4) May limit car choices

If you buy a used car with financing, you may be limited in what kind of vehicle you can pick out. If you don’t have the cash on hand for a down payment or trade-in value, they may require that you purchase a vehicle that is low-risk. This could mean not being able to get the car of your dreams.

5) Positive or Negative effect on Credit History

If you purchase a used car with financing, it’s likely that your credit history will end up being better or worse. If you are punctual with your repayments, it will make your credit rating improve. If you fall behind, that may lower your credit rating. This will adversely affect your future possibilities.

6) Higher Interest Rate

Financing a used car generally means that you will have to pay higher interest rates. Financing typically means you end up paying more than what the car would have cost you if you had bought it outright. The interest rates of financing a used car are amongst the highest.

Conclusion

So, we recommend you not to finance a used car. Even though you’ll save money in the short term, there are some drawbacks. The sooner you start saving up for purchasing your used car, the sooner you can use this money to purchase your dream vehicle with cash.

Anyway, the decision is up to you. If you have any comments or questions about financing a used car, feel free to comment below!