Owing to certain projections in the 2022 Budget which have informed further interrogation of the fundamentals, JOSEPH INOKOTONG highlights influential areas that tend to lend credence to the notion that the year 2022 is likely to be more turbulent in the annals of Nigeria’s economy.

After enduring the economic turbulence of 2021, most Nigerians had hoped for a better year this time round, banking on the 2022 Budget to give them the much needed respite against the nation’s crumbling economic structures. But less than two months into the year, signs that the worst is not over yet are manifesting everywhere. The Academic Staff Union of Universities (ASUU), owing to the prevailing economic situation and inability of government to fulfill its obligations to it, has shut down government owned varsities, signalling another round of crisis in that sector that has, no doubt, not been addressed in the 2022 Budget.

However, with all the country’s socio-economic problems still very much virulent, coupled with the current hardship Nigerians are facing over unavailability of premium motor spirit or petrol, is there any hope that the budget as assented to by President MuhammaduBuhari can provide the much needed relief, given some of the contradictions it notably contains? What, in fact, are the fundamentals of the budget?

It was not surprising to many Nigerians when President Buhari assented to the N17.13 trillion 2022 Appropriation Bill and the 2021 Finance Bill on December 31, despite his reservations over observed alterations, additions and changes to the original document by the National Assembly. The president had given his reason for that decision, by not allowing the 2022 budget to suffer a similar fate like the 2021 Electoral Bill, on his desire to maintain the predictable January to December fiscal year and enable implementation to commence on 1st January. The budget’s effective implementation, he had suggested, is very critical for delivering government’s legacy projects, promoting social inclusion, and strengthening the resilience of the economy.

Also, as directed by the president, the executive is expected to submit an amendment and/or virement request as soon as the National Assembly resumes in order to mitigate the possible impact of some changes made by the lawmakers to the 2022 executive budget proposal.

However, despite the flurry of activities by both the executive and legislative arms of government, which gave birth to the Appropriation Act tailored to improve the lots of the populace, many people still remain sceptical about the government’s capacity to implement the budget successfully considering the challenges. Their scepticismcentres on the premise that the fundamentals of the budget are not right hence the inherent inability to deliver on set revenue targets, which would invariably impact negatively on its effective implementation.

Based on this, heightened apprehension has enveloped the citizenry, reinforcing the anxiety of workers on the prospects of a better economy with potential for inclusive growth and shared prosperity. For instance, this year, it is projected that Nigerians would likely witness a more turbulent economy than experienced at the peak of the COVID-19, owing to a number of factors, one of which is unrealistic budget, whose fundamentals are not based on near accurate projections.

In this regard, a cursory look at the assumed contributions of the petroleum sector to the government’s revenue earnings may suffice. In the 2022 budget, Nigeria estimates its crude oil production to be 1.88mbpd at the price of $62 per barrel. Although the projected price may be conservative enough, the same cannot be said of the production target.

The business of crude oil production is very oily, signifying the unpredictable nature of the sector. With the level of insecurity in the country, and especially the subdued restiveness in the Niger Delta where crude oil is produced in large quantities, it is doubtful if the government can meet its assumptions.

Fortunately, OPEC crude production is projected to average 28.34 million barrels per day in 2022 higher than the 26.94 million barrels per day forecast for 2021, and the National Assembly maintained the proposed production volume of 1.88mbpd (including condensates) in 2022.

However, government seems to find consolation in the fact that growth enamoured by the non-oil sector has shown greater resilience, recording 5.44 per cent in real terms during Q3 2021. The growth recorded in this sector was mainly driven by trade, Information, and Communication (Telecommunications). Other drivers include Financial and Insurance (Financial Institutions); Manufacturing (Food, Beverage & Tobacco); Agriculture (Crop Production); Transportation, and Storage (Road Transport). In real terms, the non-oil sector contributed 92.51 per cent to GDP in Q3 2021, higher than the share recorded in Q3 2020 which was 91.27 per cent.

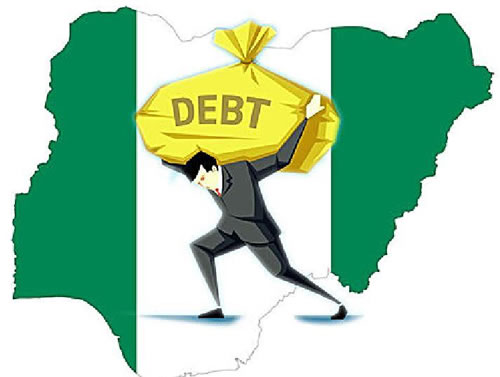

Another area that tends to paint a picture of a turbulent economy for Nigerians in 2022 is the recurring issue of debt. Nigeria’s Debt Management Office (DMO) puts the country’s total public debt stock at N35.465 trillion as of June 30 2021. The problem here goes beyond sustainability because like the Minister of Finance, Budget, and National Planning, Mrs. ZainabShamsuna Ahmed, said, “borrowings are essentially for Capital Expenditure and Human Development as specified in Section 41(1)a of the Fiscal Responsibility Act2007 and within sustainable limits”.

Nigeria’s Budget Deficit to GDP was -4.3 percent, as of November 2021, and Debt to GDP ratios of 30 per cent, as of September 2021, is said to be the lowest among Africa’s leading economies. However, Nigeria’s debt service to revenue ratio officially put at 76 per cent, as of November 202,1 is the highest among the same African top economies. This is proof that what the country is experiencing transcends a classic debt sustainability problem, but an acute revenue challenge.

Of the N17.13 trillion aggregate expenditure, which is inclusive of Government Owned Enterprises (GOEs), the projected aggregate revenue available to fund it is N10.74 trillion. If the government is able to generate that amount of revenue only, it means that the balance would be borrowed, thereby further increasing the debt stock, and leaving it with so little for developmental purposes. Already, so much has been set aside for debt servicing this year. At N3.61 trillion for debt servicing, which is 21 per cent of total expenditure, and 34 per cent of total revenues, only N5.96 trillion, which translates to 35 per cent of the total expenditure is earmarked as Aggregate Capital Expenditure.

An economist, chartered accountant, and public finance expert, Mr. CijeyuOjong while reacting to the country’s debt situation said: “Nigeria’s public debt stock has been rising geometrically over the past few years and the country now runs the risk of sliding down the slippery slope into a debt overhang that could ruin the supposed gains of the historic $18 billion debt relief achieved in 2006”.

Mr. Ojong, a foundation staff at the DMO and part of a core team that crafted the strategic framework for the sustainable management of Nigeria’s public debts and the lead officer for the resuscitation of the Federal Government Bond Issuance in the financial markets with sustained monthly issuance that has endured up till date, advised that “Proactive fiscal measures have to be urgently forged and timely action taken to rein-in the current borrowing spree if the ominous economic clouds hanging in the horizon are to be quickly dispersed”.

The economist who has equally served as Senior Special Assistant to the Minister of Finance in the area of Policy and Institutional Reform, and as Technical Adviser to the defunct National Economic Management Team (NEMT) from 2009 to 2011further stated; “Suffice it to say that real and present danger exists for the country around issues of fiscal sustainability, financial fragility, credit ratings and the threat to inter-generational equity that requires unwavering leadership commitment and technocratic diligence to forestall. Issues of inter-generational equity have to be given serious consideration and prominence in policy-making to the extent that government is a continuum and held to be a corporation sole with the common seal and perpetual succession”.

Another concern of Nigerians for the economy in 2022 is the World Bank projection that the Nigerian economy would grow by 2.5 per cent in 2022, up from an estimated 2.4 per cent growth in 2021. These numbers are not in sync with the 4.20 per cent GDP growth rate key assumption of the 2022 budget framework.

The Bank in its latest Global Economic Prospects reports added that the rising inequality and security challenges were particularly harmful to developing countries, further predicting per capita income to be lower in 2022 than a decade ago in countries such as Angola, Nigeria, and South Africa. “After barely increasing last year, per capita incomes are projected to recover only at a subdued pace, rising 1.1 per cent a year in 2022-23, leaving them almost 2 per cent below 2019 levels. In South Africa and Nigeria, per capita incomes are projected to remain more than 3 per cent below pre-pandemic levels in 2023,” the report reads.

President of the World Bank, David Malpass, expressed concerns about the world economy simultaneously facing COVID-19, inflation, and policy uncertainty, with government spending and monetary policies in uncharted territory.

“Activity in service sectors is expected to firm as well, particularly in telecommunications and financial services. However, the reversal of pandemic-induced income and employment losses is expected to be slow; this, along with high food prices, restrains a faster recovery in domestic demand. Activity in the non-oil economy will remain curbed by high levels of violence and social unrest, as well as the threat of fresh COVID-19 flare-ups with remaining mobility restrictions being lifted guardedly because of low vaccination rates – just about 2 percent of the population, had been fully vaccinated by the end of 2021,” said Malpass.

Though these are issues of concern to many Nigerians, more worrisome is the Federal Government’s resolve to remove petrol and electricity subsidies in order to meet its financial obligations. Mrs. Ahmed said the provision for fuel subsidy in the budget would run till June 2022, after which government would decide on what to do, noting that continuing with petroleum subsidy goes against the Petroleum Industry Act (PIA) which prohibits subsidy payment in the sector. When these actions are taken, the organisedLabour is likely to respond accordingly, as no one expects it to watch helplessly as the imminent economic hardship takes its toll on the populace.

On the likely merging of MDAs in a bid to cut cost, which may result in job losses, Mrs. Ahmed said during the public presentation and breakdown of the highlights of the 2022 Appropriation Act in Abuja that reducing the size of government has become imperative given the huge amount the government spends on recurrent expenditure annually. This implies that some staff of the federal government will lose their jobs when government merges their agencies with others. However, the government’s mode of reducing the workforce, as she pointed out will not entirely be in line with the Stephen Oronsaye report but based on the recommendation of a committee. She noted that the government is already working on an “exit package” to be paid to those that will be affected.

Mrs. Ahmed had said: “there is a special committee led by the Secretary to the Government of the Federation (SGF) that is working on the review of agencies with the view to collapsing them partly using the Oransanye report. At the end of it, what we want to do is to reduce the size of government and also to reduce the size of personnel cost and part of it will be designing the exit packages that are realistic”.

This scenario signposts a difficult year for the economy, which obviously should give Nigerians a cause for worry. Being a year that the tempo of electioneering is expected to peak, much money would be in circulation; both the fiscal and monetary authorities must put in place measures to curb the likely fallout from the political activities.

Furthermore, for a president whose tenure is going to end in May 2023, and who has only this year to implement his administration’s cardinal programmes in full, he may take far-reaching actions to achieve the set goals, which could throw up unintended adverse consequences for the economy.

In the words of Mr. Ojong, “proactive fiscal and monetary measures have to be urgently forged and timely action taken to rein in the current uncertainties in the economy if the ominous economic clouds hanging in the horizon are to be quickly dispersed”.

ALSO READ FROM NIGERIAN TRIBUNE

- (BREAKING): NDLEA Declares DCP Abba Kyari Wanted Over Alleged Involvement In Drug Deal

- Igboho Files $1 Million Suit Against Benin Republic For Unlawful Detention, Violation Of Rights

- Marburg Virus: What You Need To Know About Disease Recently Detected In West Africa

WATCH TOP VIDEOS FROM NIGERIAN TRIBUNE TV

- Let’s Talk About SELF-AWARENESS

- Is Your Confidence Mistaken for Pride? Let’s talk about it

- Is Etiquette About Perfection…Or Just Not Being Rude?

- Top Psychologist Reveal 3 Signs You’re Struggling With Imposter Syndrome

- Do You Pick Up Work-Related Calls at Midnight or Never? Let’s Talk About Boundaries