Entrepreneurs ideate businesses to fill identified gaps in the economy. They determinedly execute their business ideas from conceptualization to realization. Their efforts always result in the products and services we continuously crave for. They are innovators. They are disruptors. They are job creators. They are the human species that brought Facebook, Google, Samsung, LG, Globacom, Dangote Group and a host of other brands into existence.

Entrepreneurs are drivers of economic growth. The Global Entrepreneurship and Development Institute recently published its 2017 Global Entrepreneurship Index. Nigeria got a score of 19.9 and occupied the 100th position among the 138 countries evaluated. The United States came first with a score of 83.4; Switzerland followed with a score of 78; Israel with a score of 59.1 was in the 17th position; and UAE with a score of 58.8 was in the 19th position. From the foregoing, there is undoubtedly a positive correlation between entrepreneurship and economic growth.

In essence, our hostile business environment to entrepreneurship chiefly accounts for the economic contraction that Nigeria is currently experiencing. In 2016, the Nigerian economy contracted by almost 2 percent. According to the World Bank, the country’s GDP per capita was $2,820 in 2016.The CIA World Factbook gave the Nigerian population living below the poverty line as 70 percent and unemployment rate as 23.9 percent.

The unfriendly business climate in Nigeria was further buttressed by the 2017 Ease of Doing Business Rankings. Out of the 190 countries examined, Nigeria was ranked 180 when the ease of ‘Getting Electricity’ was considered. Nigeria was ranked 138 when the ease of ‘Starting a Business’ was considered. The challenges of doing export and import transactions were brought to the fore as Nigeria was assigned the 181st position when ‘Trading across Borders’ was considered.

Nigeria has a poor saving culture. Its Gross National Saving was 13.1 percent of GDP in 2016. This was much lower than Singapore’s 46 percent and South Korea’s 36.1 percent. These emerging economies must be appropriately benchmarked if Nigeria must generate adequate funds for investments in startups.

Access to capital is the most critical factor for entrepreneurial success. Thus, the financial authorities must urgently develop a robust ecosystem that enables entrepreneurs and investors to network seamlessly in Nigeria. The starting point should be the provision of a functional framework for the operation of crowdfunds. Emerging entrepreneurs can obtain equity capital for their startups through crowdfunding. Many businesses have been launched in Britain and USA by sourcing funds from websites created for capital rising. The following can serve as good models: Kickstarter, Gofundme and Fundable.

In addition, communities of angel investors must be created for startups to have access to equity funds. Again, the relevant agency should spearhead this by creating a reliable website to enlist all eligible angel investors. A website similar to America’s Angel list (https//:angel.co) must be created. This will provide entrepreneurs the opportunities to make online presentations of their business plans with a view to raising the required capital. Conferences can be organized monthly or quarterly for entrepreneurs to pitch their businesses before angel investors. Angel investors will be able to identify viable proposals and invest accordingly.

The financial market for venture capital is still underdeveloped in Nigeria. Private Equity Firms must be established to bridge this gap. This can be achieved by encouraging banks, insurance companies and pension institutions to create subsidiaries that will operate as private equity firms. They will be able to provide venture capital to entrepreneurs. Moreover, the managerial expertise of participating venture capitalists will be helpful in the successful operation of new enterprises. The Nigerian firms can adopt the operational modalities of the following venture capitalists which have successfully funded large ticket deals: 500 startups, Seedstars Africa, Acumen Fund, and Goldman Sachs Capital Partners.

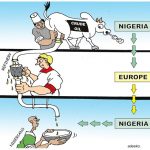

Diaspora remittance to Nigeria in 2016 was $35 billion. There is a compelling need for Nigerian banks to develop financial products that will be capable of attracting funds from the Diaspora into viable enterprises. Nigerians who are residing in foreign countries always search for investment opportunities at home. They must be incentivized to participate in growth-inducing enterprises.

Entrepreneurs have to keep up with modern business practices. They must be able to write sellable business plans. They must regularly hone their skills in the areas of management, record keeping, accounting, marketing and customer satisfaction. The Government can engage knowledgeable consultants to provide entrepreneurs with requisite skills on a quarterly basis. Frequent training will immeasurably help entrepreneurs to succeed in the marketplace despite the effects of ever changing business environment.

The regulatory agencies must stop functioning as impediments to business operations. Agencies like NAFDAC and SON must simplify the process of registering manufactured products. They must also reduce the number of weeks it takes for an enterprise to get its products approved. As they work to prevent the sale of sub-standard products, they must be business-friendly in their approach. Genuine producers should be able to operate with the assurance that Government agencies are their friends.

Industrial parks are required in each of the 36 states. The industrial parks must have access to uninterrupted independent power supply.

Factory units in the industrial parks must be designed to accommodate light manufacturing. Entrepreneurs can lease factory units, move in their machinery and begin production. This will be the beginning of industrial revolution in Nigeria.

Harnessing the entrepreneurial talents of Nigerians for economic development is the unassailable solution to the country’s economic struggles.

Nigeria will be placed on the trajectory of growth as entrepreneurs permeate strategic sectors like agriculture, manufacturing, renewable energy, technology, mining and tourism.

The government, the business community and the citizens must collaborate to achieve this goal for a prosperous Nigeria to emerge within the next decade.

Adesuyi, Managing Director, Wealthgate Advisors can be reached via wealthgateadvisors@gmail.com