Minister of Finance, Mrs Kemi Adeosun who stated this at a press briefing in Abuja on Thursday said the target for the project is to increase the present number of tax paying Nigerians to between 17 million and 18 million from the present 14 million in the next two years.

Adeosun said that the recruits would visit schools, churches, mosques, markets and other social places to educate people on the tax system and let them know their obligations.

“We will be recruiting them through N-Power and they can apply through the website of the Federal Ministry of Finance or through the N-Power website.

“It’s a two year fixed contract and they will be deployed to states, attached to state Internal Revenue Service or FIRS. Their job is to improve the level of education on the Nigeria’s tax system.

She said the recruits would be recruited under the N-Power Programme and paid N30, 000 monthly including receiving other performance-based incentives measured by the number of people they enrolled into the active tax-paying register during the two-year fixed period.

“Our tax system is progressive, meaning those who earn less should pay less and those who earn more should pay more.

“A lot of people don’t know that. So it’s a chance to get people on ground to answer all these pertinent questions,” she said.

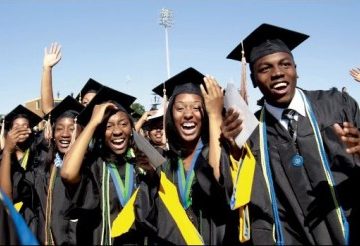

Adeosun said that graduates of accounting, economics, mathematics and other relevant courses would be given priority under the programme.

She, however, encouraged intelligent graduates interested in a career in tax administration to apply as the government planned to sponsor the recruits to become tax professionals.

“This exercise is extremely important for the fiscal sustainability of states because as you know, most of the revenue for states apart from FAAC is supposed to come from tax.

“So if we improved the number of taxpayers, we will be improving the fiscal health of our state governments as well as the Federal Government.

“It’s an important initiative for the nation as we undertake reforms to reduce our over dependence on oil.

“We have to make sure that everyone who is economically active pays tax, no matter how little, they have to contribute to the pool,” she said.