Sixty-four years after Independence, Nigerians decry homelessness in the land, seek improved housing sector. DAYO AYEYEMI reports.

EXACTLY one week ago, the Federal Government rolled out the drums to celebrate the nation’s independence at 64 years. Looking back, Nigerians, especially experts have been appealing to the government to do more in enhancing home ownership among Nigerians.

They are canvassing for an improved housing sector where Nigerians can realize their dream of home ownership.

They pointed out that Nigeria’s harsh economy has increased homelessness among the citizens, citing high inflation rates to fluctuating foreign exchange, high unemployment rates, widespread poverty, security concerns and corruption, the purchasing power as inhibiting factors to homeownership in the country.

Besides, the high cost of land, high building materials’ cost, lack of access to good infrastructure, frequent building collapse incidents, lack of affordable mortgage, lack of virile mortgage sector, poor housing finance, high interest rates on loans from banks, bottleneck procedures associated with planning permit and issuance of Certificate of Occupancy, and poor housing policies are still major factors inhibiting access to affordable homes by citizens after 64 years of nationhood.

Currently, one-bedroom apartment costs between N25 million and N42 million, depending on location and finishing materials while rent for the same property can be as high as N500,000, N1 million per annum in a country where national minimums wage of N70,000 per month is yet to be implemented in many states of the federation.

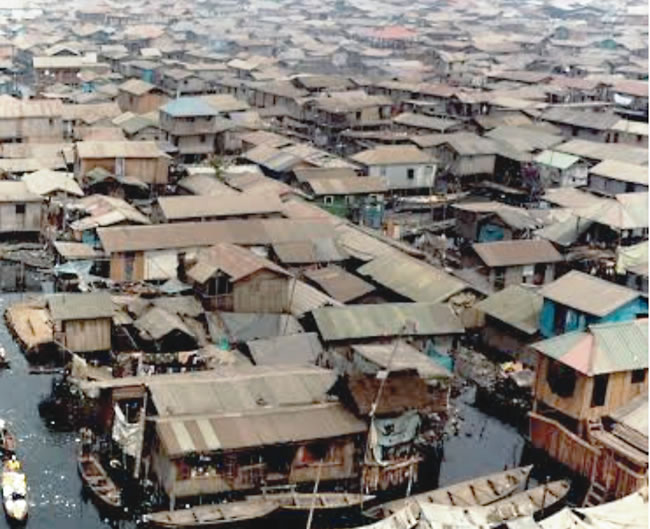

Despite several initiatives namely; the National Housing Fund (NHF), Federal Mortgage Bank of Nigeria (FMBN), Nigerian Mortgage Refinance Company, Family Homes Funds (FHF), Association of Housing Corporation of Nigeria (AHCN), and Federal Housing Authority (FHA) , the nation’s deficit is estimated at 22 million units, while many Nigerians live in slums/unhealthy environment.

In May 2,2024, now fewer than 86 illegal squatters were evicted from under Dolphin Bridge in Ikoyi, where they paid N250,000 each annually for under-bridge makeshift apartments.

Commenting, many experts that spoke to Nigerian Tribune, said that there was no impressive performance but wanted government to take the provision of affordable housing for the citizens seriously.

Some of the experts include the West African Chapter Chairman, African Real Estate Society (AFRES), Mr. Kunle Awolaja; Public relations officer, Lagos State chapter, Nigerian Institute of Building (NIOB) Akingbade Adekola; Executive Secretary, Association of Housing Corporation of Nigeria, Toye Eniola; Principal Partner of Femi Oyedele & Co/ CEO of Fame Oyster & Co. Nigeria, Femi Oyedele; Founder, Cromwell PSI, Sola Enitan; and President, International Facility Management of Nigeria, (IFMA), Lekan Akinwunmi.

Commenting, Awolaja said that, according to a recent housing market survey in Nigeria, there were 23 dwellings for every 1000 inhabitants.

“The country’s estimated housing deficit as of November 2022 was a shocking 25 million units, an increase of over 15 percent from January 2019 data. The deficit must be covered with around N21 trillion in funding for housing development,” he said.

Besides, he said the mortgage fund, to a large extent, has not made access to housing loans accessible and seamless due to unrealistic demands and stringent documentation process thereby creating a vacuum for exploitations.

He explained that the housing deficit in Nigeria remained a complex issue that would require collaboration between the government, private sector and financial institutions.

A combination of affordable housing projects, mortgage financing, innovative building materials, and streamlined land policies, Awolaja said could help close the housing gap.

“Long term urban planning and infrastructure development will also be critical in sustaining housing delivery efforts across the country,” he said.

Oyedele did not mince words, saying that the housing sector has performed wobbly in the last 64 years if compared the achievements with where the sector supposed to be.

“We have a large housing deficit of about 20 million units. Nigeria has one of the largest number of slums in the world with over 500 squalid settlements scattered around Nigeria. Housing, which is a basic need, is not within the reach of average Nigerian. It is yet not an Uhuru.

“The mortgage and building materials sub-sector is yet not matured. The percentage of prospective house-owners who approach the mortgage banks is negligible. The mortgage banks cannot meet the loan requirements of these negligible customers because the banks are underfunded.

“The building materials sub-sector is unorganised, highly-dependent on foreign building materials and highly affected by foreign exchange rate fluctuations.

“Affordability Index of housing in Nigeria is ridiculously low and people cannot access the housing markets because of the high cost of building materials,” Oyedele itemised.

He suggested the need for improving land titling to revive the dead capital in Nigeria.

He also canvassed for massive investment of government in local building materials’ manufacturing, adding that there should be distinction between economic and social housing.

“Since Nigeria is a signatory to Article 25 of 1948 which stated that housing is a right of everyone in Nigeria, and since this has been enshrined in our 1999 constitution of the Federal Republic of Nigeria, the governments at all levels must declare state of emergency on housing and provide “welfare housing” for workers, social housing for the poor people, home for the homeless for the unemployed who sleeps on streets and on canters in the markets and ensure everybody can sleep in a decent accommodation.

Akingbade pointed out that Nigerians faced difficulties in accessing affordable housing finance, especially low and middle-income earners and those in the informal sector.

In addition, he said that the National Housing Fund, which was established to provide mortgage lacked sufficient funding.

To address the housing deficit and improve the mortgage sub-sector, he said the government and stakeholders must work together.

At 64, Eniola said the housing sector is far from impressive, pointing out that the housing deficit was getting wider as the supply of the needed affordable housing was far below the demand.

“Nigeria population is estimated to be about 220 million in 2023 with about 2.40 percent annual growth whereas the total housing units developed by the federal government between 2015 and 2023 was a little over 6,000 housing units.

“According to a report by the Centre for Affordable Housing Finance in Africa (CAHF), 58.8 percent of Nigeria urban population lives in slums indicating a substantial demand for affordable housing with basic infrastructure.

“So Nigeria housing sector still has a long way to go in terms of policy and regulatory implementation, attraction of housing financing into the sector, activation and implementation of viable mortgage market, land and titling administration and, of course, provision of appropriate housing data system that could engender good planning to enhance activities in the sector,” Eniola said

He pointed out that at 64, the mortgage system in the country is crawling and contributing very little to nothing to the economic growth of the nation.

“Mortgage contributes just about 0.6% to Nigeria GDP whereas mortgage drives most of the developed economies,” he said.

According to the AHCN executive secretary, there’s nothing to write about the building materials’ sub-sector as high energy cost, rising inflation and volatile foreign exchange rate for those who import raw materials have driven most of those who weathered the storm to continue in production to oblivion.

“We now depend on substandard building materials as Nigeria now has become a dumping ground for substandard materials from China,” Eniola said.

He called for a new orientation and education about the importance of the sector to economic growth while appealing to the nation’s political leaders to be more committed to provision of affordable and social housing to Nigerians

Otunba Sola Enitan, a lawyer and estate surveyor, described the Nigeria’s housing sector as a critical part of its socio-economic structure of the nation but characterized by significant challenges.

“The country faces a housing deficit estimated to be between 17 to 20 million units, compounded by high population growth at about 3 percent annually, rapid urbanization due to infrastructure deficits in rural areas, and stagnant income levels oscillating currently at about 50 cents per day,” he said

While some efforts have been made to bridge the housing deficit gap of over 20 million units, such as the National Housing Fund (NHF) and various state-level initiatives, Eniola said they have largely failed to meet the growing demand for affordable housing due to several socio-economic malaise including corruption.

He listed the challenges of the sector and suggested ways out of the woods.

To overcome these challenges, he said that Nigeria will need a multi-faceted, collaborative approach, combining government’s policy reforms, private sector investment and international assistance.

Lekan Akinwumi remarked that the housing sector has always been a challenge that is as old as the nation itself, recalling that the creation of various housing schemes has turned out to be political, which has made the policy unsustainable.

“If the housing problem is to be solved, the people’s culture should be factored into the policy,” he said.

READ ALSO: Rivers crisis: Tell Wike to allow Fubara breathe, Bode George charges Tinubu

WATCH TOP VIDEOS FROM NIGERIAN TRIBUNE TV

- Let’s Talk About SELF-AWARENESS

- Is Your Confidence Mistaken for Pride? Let’s talk about it

- Is Etiquette About Perfection…Or Just Not Being Rude?

- Top Psychologist Reveal 3 Signs You’re Struggling With Imposter Syndrome

- Do You Pick Up Work-Related Calls at Midnight or Never? Let’s Talk About Boundaries