This was just as he said there was a lot government at all levels in the country needed to do right in terms of reforming tax administration to ensure that taxpayers feel a little bit happy performing their civic duties diligently.

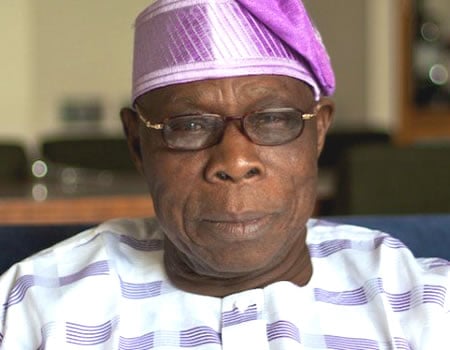

Obasanjo said this on Saturday in Lagos while speaking as chairman at the launch and public presentation of a book titled, “A Review of Effective Tax Regime in Nigeria,” written by former Deputy Inspector-General of Police (DIG), Mr Tunde Ogunsakin.

The former president, who spoke at the event, which took place at the Institute of International Affairs (NIIA) and attended also by former Cross River State governor, Mr Donald Duke; National Publicity Secretary of Peoples Democratic Party (PDP), Prince Dayo Adeyeye: immediate past president of Nigerian Stock Exchange (NSE), Aigboje Aig-Imoukhede; former Deputy Governor of Central Bank (CBN), Mr Tunde Lemo, Prof Wale Omole, Mr Folu Olamiti, among others, however, said should the tax payers for any reason see that what they paid was being diverted illegally, they would have no cause to continue to pay.

Obasanjo, while noting the significance of tax and taxation to any country, lamented the situation whereby some people and corporate bodies deliberately avoid paying their taxes, saying there was need for government to take inventory of how much the country was losing annually to tax evasion.

According to him, Nigeria needs to know how much it is losing annually to tax evasion or failure to pay taxes as at when due, recalling that the African Union (AU), not long ago, set up a body that came out with a report that the continent was losing annually a whopping sum of $50billion to what he termed “illegal or illicit money.”

“Why should we not be able to find out how much do we lose annually by people not paying their taxes as they should pay? At the AU level not long ago, AU set up a committee under President Thabo Nbeki to find out how much Africa is losing in illegal or illicit money and it came up with $50billion.

“I think we need to do similar exercise by looking at how much we are losing by people not paying their taxes as at when due or underpaying their taxes,” Obasanjo said.

The former president commended the author, Mr Ogunsakin, for a job well done, just as he commended the book to tax authorities at the local, state and Federal Government levels, contending that there was a lot that needed to be reformed in the country’s tax administration.

“I commend this book to those who are administering taxes at the local government level, the state level and the Federal level. There is a lot they would need to reform. There is also a lot to do right on the use of taxes that they collected so that people who are paying taxes can feel a little bit happy that the money that they pay is judiciously utilised,” he said.

Governor Ambode, in his remark, while noting the dwindling revenue now available to the country which he said was barely enough to pay salaries, said it had become compelling for those in charge to redirect attention to the whole system of tax administration in the country in order to make it more efficient and effective.

According to Governor Ambode, who was represented by the Chairman, Lagos State Internal Revenue Service (LIRS), Mr Subar, the importance of taxation to any economy cannot be overstressed, saying It was a major tool for socio- economic development.

“It is the most important and reliable source of revenue for any government to implement its programmes as a result of dwindling revenue from Federation Account which is barely sufficient for payment of salaries,” he said.

To this end, he said for government at all levels to be self-sufficient and financially independent, there was need to look inwards and establish an efficient and effective system of taxation in order to improve their Internally Generated Revenue (IGR).

“Ladies and gentlemen, for us to achieve our desired goal, we must continue to reform our tax system to conform with current global best practices. The reform must be one at making the system technologically driven, people friendly and ensure that more people are brought within the tax net,” he said, lamenting that, “The current GDP ratio of between 5 and 6 per cent is clearly indicative of weak tax system.”

The governor, while describing the book as a welcome development, said it would help policymakers and tax practitioners, including stakeholders to get ideas and strategies that could be adopted to strengthen the system.