The power sector is a very crucial one as it determines the socio-economic vibrancy of any society. However, the country has continued to grapple with epileptic electricity supply in spite of the privatisation of the sector in 2013. ADETOLA BADEMOSI writes on the challenges bedevilling the industry.

THE Nigerian Electricity Supply Industry (NESI) is one critical sector that has continued to experience setbacks due to issues ranging from liquidity shortfalls, inconsistency on the part of key players to infrastructure deficits, among others. And to think that this directly affects the supply of electricity consumers is a major concern to all.

Before privatisation, the defunct Power Holding Company of Nigeria (PHCN) used to be in charge of generation, transmission and distribution of electricity but by 2013 the generation and distribution aspects were unbundled and sold to private investors – power generation companies and distribution companies (GenCos and DisCos) – while the Federal Government retained ownership of regulatory and transmission aspects through the Nigerian Electricity Regulatory Commission (NERC) and Transmission Company of Nigeria (TCN).

Interestingly, the value chain structure is one that is interwoven and as a result, the inconsistency of one, affects the other. Little wonder then that the DisCos being the nearest to consumer have been at the receiving end for general poor performance in power supply. This is because DisCos distribute power to consumers and remit their collections to the Nigerian Bulk Electricity Trading Company (NBET), which in turn pays the GenCos for power generated.

Apart from being blamed for poor power supply, the DisCos also carry the blame for most of the inconsistencies in the sector like non-remittance 100 per cent to NBET, non-investment in distribution networks and non-fulfilment of the contract agreement with the government. This is bearing in mind that the government also holds a 40 per cent stake in distribution.

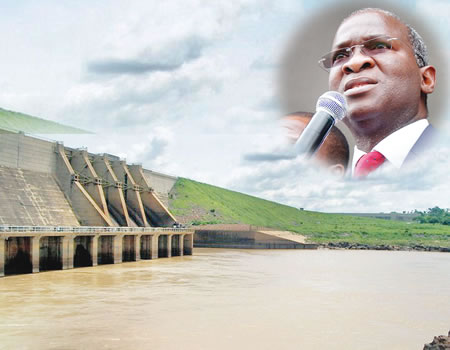

Even the Minister of Power, Works and Housing, Mr Babatunde Fashola, at a briefing on Power Sector State of Play, Next Steps and Policy Direction, in Abuja, blamed the DisCos for contributing to the majority of the challenges in the sector “despite the government’s efforts at addressing such.”

Stranded 2,000MW controversy

Before now, Fashola had repeatedly announced an increase in generation from 5,000MW in 2015 to 7,000MW. He even boasted of a stranded 2,000MW due to the DisCos’ low capacity utilisation. He also claimed an increase in transmission from 5,000MW to a little over 7,000 MW, a development he further credited to the ongoing Transmission Expansion Programme (TREP).

The implication of this claim that Nigerians should now have access to improved power supply, but the reverse is the case. According to him, “…the problem today is that the DisCos cannot distribute all of the power that is available, leaving the sector with an unused capacity of 2,000 MW with the approximately 1,150 MW projected to come this year and 2019,” he had said.

What then is the problem? The 11 DisCos, speaking through their umbrella body, Association of Nigerian Electricity (ANED), however, disagreed with the minister’s position. They claimed that there was no stranded 2,000MW anywhere, that as of January 28, 2015, before the current government came on board, the generation availability was 6,421 MW, which is divided into peak of 4,230MW and constrained energy of 2,191MWs.

“…It is misleading to state that available generation has grown from 4,000 MW in 2015, as a measure of progress, given that a volume of generation slightly under 7,000 MW already or previously existed, prior to the beginning of this administration,” they said

Association of Nigerian Electricity Distributors’ (ANED) Director of Advocacy and Research, Mr Sunday Oduntan, a lawyer, noted that though there is an available capacity of 7,000MW, only 5,000MW can be generated due to insufficient gas to power the thermal plants and the absence of a commercial framework that would encourage gas exploration.

On the increase in transmission capacity and other ongoing transmission expansion programmes by the Federal Government, the DisCos averred that the government should rather focus on strengthening the grid, noting that this should be in tandem with the DisCos infrastructure expansion plans.

ALSO READ: Davido shares how Tekno enriched him

Liquidity shortfall

Apparently, the key challenge that seems to be rocking the electricity sector is liquidity shortfall, which has continued to threaten the business of investors in the industry. The legacy debts inherited by the DisCos among other regulatory issues seem to be taking its toll.

Interestingly, NBET, a government-owned company established as an intermediary between the GenCos and DisCos have continued to lament under-remittance by the DisCos, leading to a total debt of N859 billion owed to it by electricity distributors.

Contributing to the liquidity issue, ANED’s Mr Oduntan at a briefing recently in Abuja explained that the financial crisis in the industry started due to regulatory restrictions which led to the removal of collection losses, freezing of the tariff for R2 residential class for 18 months, non-payment of N100 Billion subsidy for 2013 and 2014, under-recovery of required revenue, non-implementation of Minor and Major Tariff Reviews, among others.

According to him, this constrained the DisCos from recovering the cost of energy supplied and reducing inability to enter into contracts to directly purchase energy from GenCos.

He noted that the regulatory order that placed a caveat on the average tariff DisCos can bill their customers further deepened the liquidity crisis noting that: “Like any commercial transaction, such contracts must be based on prices that are mutually sustainable for the contracting parties. As an example, how is a DisCo which today has an average tariff to customers of N32/kWh instead of N45/kWh be expected to contract for bilateral power for which it would pay N100/kWh for? The major reason adduced by the government and the regulator for this situation, so far, has been the need to manage the implications of appropriate pricing on the populace and the government.”

Oduntan also faulted assertions that the DisCos were unwilling to maximise electricity supply to their customers. He argued that the impact of revenue shortfall, which limits the available capital available to invest in power was likely to constrain a DisCo to take more energy.

Bridging metering gap and N305bn CAPEX

Perhaps the most contending issue affecting power consumers is the problem of estimated billings. The call for criminalisation of this collection methodology has been debated even at the legislative level due to complaints of extortion by consumers against the DisCos in a bid to compel them to commence massive installation of meters for all consumers in the country.

The bill, which was sponsored by the Majority Leader of the House, Mr. Femi Gbajabiamila, was entitled, ‘A Bill to Amend the Power Sector Reform Act to Prohibit and Criminalise Estimated Billing by Discos and provide for Compulsory Installation of Pre-paid Meters for all Power Consumers in Nigeria’.

Gbajabiamila, had argued that it was not justifiable for consumers to pay for power not consumed through estimated billings

At the 18th monthly power sector and stakeholders meeting in August 2017 Fashola had stressed that the supply of meters to electricity customers was not exclusive to the DisCos, calling on investors to bridge the gap. This led to the enactment of the Meter Asset Provider (MAP) regulation by the NERC.

According to Mr Oduntan the importance of metering to reduction of collection losses cannot be overemphasized He said the 4.1 million metering gap is a legacy of 62 years of government under-investment and inefficiency.

He added that the metering gap however exceeds the 1.7 million metering obligation specified in the DisCos’ performance agreement. According to him a sum of N299 billion out of the N305 billion total capital expenditure (CAPEX) will be required to bridge the gap.

The N305 billion CAPEX covers for all metering, network expansion, rehabilitation and replacement of transformers, injection stations, etc for 11 DisCos to be utilised for over five years.

“…In simple terms, the cost of comprehensive metering, currently, simply dwarfs the ability of the current tariff to accommodate same. It means that the already artificially suppressed tariff cannot accommodate the cost without an increase,” he said.

He submitted that metering is a tool for the DisCos to track and account for their revenues explaining that: “Metering alone reduces collection losses very significantly and improves customers› willingness to pay. Metering is a performance requirement for DisCos, in terms their loss reduction and metering targets, as specified in the Performance Agreement with BPE.”

He assured that in addition to the MAP programme aimed at accelerating the metering effort, the DisCos will continue working with NERC to improve the accuracy of the estimated billing methodology for better customer satisfaction.

It is certain that the challenges bedevilling the power are multi-dimensional and until all key players in the value chain genuinely come together to work for a common goal, which is providing improved access to power to the remotest village in the country, all past and ongoing efforts may end up in smoke..