YEJIDE GBENGA-OGUNDARE in this piece, reviews the new Withholding Tax known as the Deduction of Tax at Source (Withholding) Regulations 2024, which took effect from July 1 and how it affects the average Nigerian.

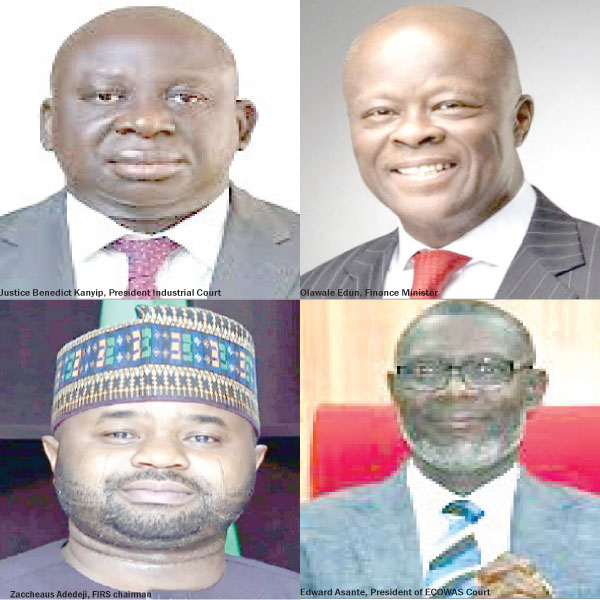

The Federal Government recently overhauled its nearly half a century-old regime on the administration of withholding tax by introducing a new regulation for Withholding Tax tagged the Deduction of Tax at Source (Withholding) Regulations (WHT) 2024 which took effect from July 1 after the Minister of Finance and Coordinating Minister of the Economy, Wale Edun signed the regulation in line with the Interpretation Act.

Withholding Tax, introduced into the Nigerian tax system in 1977 to provide the government with regular revenue flow and to curb tax evasion, in simple terms, means the tax paid from the income generated from business transactions. The tax is charged on all Nigerians, both those who are residents and non-residents.

Before the introduction of the new regulation, withholding tax was paid by the receiver of income in a given transaction. However, with this new regulation, the government has mandated persons making payment for certain transactions to deduct the tax from the sum to be paid and to remit the tax to the government on behalf of the receiver; this is where the title of the regulation, deduction of tax at source; that is, tax is removed before the payment for a contractual agreement is made, was generated.

This system is similar to the Pay as You Earn (PAYE) system used to deduct personal income tax from employees but this involves money that is paid directly to companies or businesses, being deducted by the payer and given directly to the government before payment is made to the beneficiary companies/businesses.

The new regulations are part of the reforms proposed by the Presidential Fiscal Policy and Tax Reforms Committee headed by Taiwo Oyedele and it now supersedes all previous WHT regulations, particularly the Companies Income Tax (Rate, etc., of Tax Deducted at Source (Withholding Tax)) Regulations, 1997 and the Personal Income Tax (Rate, etc., of Tax Deducted at Source (Withholding Tax) Regulations, 1997.

Generally, the deduction is to be made at the point of payment and where the recipient (business or company) of the payment does not have a valid Tax Identification Number, the payer is required by the Regulation to deduct twice the amount of the tax to be paid. After the tax is deducted, the payer is required to remit the money to the relevant tax authority.

There were obvious differences between the new regulation and old one; there is decrease in WHT rates, the rate of WHT has been reduced from 10 percent to five percent for payments to a Nigerian company for professional, management, technical and consultancy services while the WHT for these payments to a non-resident company remains at 10 percent and as before, no further tax is payable in Nigeria by the non-resident.

The rate of WHT has been reduced from five percent to two percent for payments to a Nigerian resident for any service other than professional, management, technical and consultancy services as well as the supply of goods or materials; but it excludes over-the-counter supplies of goods or materials, that is, transactions without a pre-existing contractual relationship or any prior formal agreement, where payment is made immediately in cash or via electronic means on the spot.

For payments to a Nigerian resident for co-location and telecommunication tower services, rate of WHT has been reduced from five percent to two percent and WHT for these payments to a non-resident company remains at five percent. A 15 percent WHT is now to be deducted from the earnings of non-resident “entertainers and sportspersons” and this is the final tax payable in Nigeria.

And for lotteries, gaming, reality shows, and similar activities, starting from October 1, 2024, winnings will attract WHT of five percent for a resident and 15 percent for a non-resident. And no further tax is payable in Nigeria by the non-resident.

WHT on payment to a non-resident for the construction of roads, bridges, buildings and power plants has been increased from 2.5 percent to five percent.

The WHT on payment of directors’ fees has been increased from 10 percent to 15 percent for residents and to 20 percent for non-residents and like before, no further tax is payable in Nigeria by a non-resident director.

Further, the recipient of any non-passive income liable to WHT will suffer twice the WHT rate where the recipient is not registered with the FIRS for tax and the liability to deduct and remit WHT now extends to payment agents who make payments liable to WHT.

The obligation to deduct and remit WHT now arises on the earlier of payment or settlement, rather than payment or accrual under the old regime. For connected parties, however, it remains the earlier of payment or accrual.

Categories of persons exempted from the Withholding Tax Regulation

There is, however, some categories of people that are exempted from Withholding tax obligations: Those include Individuals small companies or unincorporated entities whose gross turnover is less than N25,000,0000 provided that the supplier has a valid Tax Identification Number and the value of the transaction is N2,000,000 or less.

There are also transactions that are exempted from the Withholding Tax Regulation. They include: Across-the-counter transactions, which refers to transactions between parties that do not have an established contractual relationship, in which payment is made on the spot either with cash or by electronic means. These kinds of transactions are general and routine transactions like buying food or getting a haircut.

Also, winnings from a game of chance (betting) or a reality show that promotes entrepreneurship, academics, technological or scientific innovation; supply of petroleum products and its subsidiaries; insurance premium; commission retained by a stockbroker and out-of-pocket expenses that are normally expected to be incurred directly by the supplier and are distinguishable from the contract fees.

In addition, compensating payments under a registered securities lending transaction; any distribution or dividend payment to a Real Estate Investment Trust (REIT) or Real Estate Investment Company (REIC); interest and fees paid to a Nigerian bank by way of direct debit of the funds which are domiciled with the bank; goods manufactured or materials produced by the person making the supply or any payment in respect of income or profit that is generally exempted from tax and imported goods where the transaction does not create a taxable presence in Nigeria for the foreign supplier, are transactions exempted from WHT.

Can the new law be circumvented?

The average Nigerian is always looking for ways to evade tax and make more income. As a result, it is unlikely that there won’t be people trying to circumvent the system. But is this possible? The answer is yes. In fact, obvious way to circumvent this new law would be for businesses to include the tax as part of the contract sum to be paid to them.

But this is illegal. The Regulation states in Paragraph 3 that the tax cannot be included in the contract price as a separate price or an extra cost. The tax is a deduction from the original amount of the contract.

Once deduction is made from any payment, a receipt and a statement for the tax deducted, must be issued to the receiver of the payment as evidence of the tax paid. The receipt serves as evidence of tax payment on the transaction and can be used by the payment receiver to claim tax credits.

Assuming a payer deducts the tax and issues the receipt to the receiver of the payment but fails to remit the tax to the government, the receiver of the payment is still entitled to the tax credits. The receipt suffices as evidence of payment, and so the unremitted tax becomes a liability to the person that made the deduction, and it is recoverable with applicable penalty and interest.

Any person who fails to make a deduction at source or to remit the deduction made to the relevant tax authorities on or before the due date is liable upon conviction, to pay the sum of the tax with an additional 10% of the sum per annum and interest at the prevailing rate of the Central Bank of Nigeria (CBN).

A person who deducts withholding tax is required to issue a receipt for the tax so deducted. The receipt entitles the recipient to claim a tax credit for the amount deducted, regardless of whether the WHT has been remitted to the relevant tax authority.

It should be noted however that WHT is not to be deducted in respect of payment goods manufactured or materials produced by the person making the supply; winnings from a game of chance or a reality show with content designed “exclusively to promote entrepreneurship, academics, technological or scientific innovations, insurance premiums; interest and fees paid to a Nigerian bank through direct debit of funds domiciled at the bank and supply of liquefied petroleum gas, compressed natural gas, premium motor spirits, automotive gas oil, low-pour fuel oil, dual-purpose kerosene, and JET-A1.

It is of utmost importance that taxpayers be given advance notice of the new regulations in order to assess their impact and ensure a seamless transition.

“Businesses with existing contracts that do not account for/anticipate changes in the WHT regime would need time to obtain expert guidance on the impact of the new regulations, especially with respect to the legal, tax and financial implications of such contracts and whether the contracts need revisions to accommodate the new withholding tax regulations. Parties need to renegotiate terms to address the impact of the new regulations,” a tax expert stated.

A legal practitioner, Wonu Abass said “people need to learn to tame their temper and be open minded at this period to avoid issues. This new tax regime can cause disputes among business partners and jeopradise contractual agreements if one party is disproportionately affected.

“However, in spite of foreseen challenges, the new regulations are expected to create a fairer tax environment and ease the burden on businesses during this challenging economic period. And it is a step in the right direction by the Federal Government and the Presidential Fiscal Policy and Tax Reforms Committee deserve commendations.”

ALSO READ: Stakeholders seek Makinde’s intervention as health workers’ strike enters 60 days

WATCH TOP VIDEOS FROM NIGERIAN TRIBUNE TV

- Let’s Talk About SELF-AWARENESS

- Is Your Confidence Mistaken for Pride? Let’s talk about it

- Is Etiquette About Perfection…Or Just Not Being Rude?

- Top Psychologist Reveal 3 Signs You’re Struggling With Imposter Syndrome

- Do You Pick Up Work-Related Calls at Midnight or Never? Let’s Talk About Boundaries