As the embattled Ponzi scheme, MMM, continues to ail, holding up millions of Naira belonging to Nigerians who engaged in the money-doubling scheme, MOSES ALAO writes on how fraudsters have resorted to using WhatsApp money-doubling groups to dupe unsuspecting Nigerians.

RAPID Cash, My Money Bank, Earn Double, Capital Growth, PH 440, Twice Richer, you don’t know what these mean, do you? Congratulations, if you don’t; it means you have not suffered the fate of Adeolu, who is still smarting from the loss of about N40,000 to the ‘business’.

No, it is not what you think. It is not a business per se, or at least, dealers in this line of business do not call it business. They say it is investment and expect returns. And like every business, they record losses and gains, only that the gainers in this line of business are always few, while the losers, always in the majority, are always helpless.

Adeolu, a young man in his early 20s, was one of the losers in the ‘business’ and do not make a mistake of asking what he sells, because Adeolu, like thousands of other Nigerians, sell nothing but always expect returns on investment. “Well, I know it is not a business and that it is risky, but it is wrong for Nigerians like us to be duping us through WhatsApp,” Adeolu angrilly told Sunday Tribune.

Yes, the names above were names of WhatsApp groups created by Nigerians to fleece other Nigerians of funds. These fraudulent individuals, Sunday Tribune gathered, had, few weeks after the freezing of Mavros by the Mavrodi Moneybox Mundial, popularly known as MMM, developed a new template for Nigerians to “grow their money” by donating to others and receiving donations.

With the experience of quick cash syndrome left behind by MMM and other similar Ponzi schemes, such as Get Help Worldwide, NNN and so on, still fresh, some individuals had reportedly seen a window to “obtain” Nigerians, having notice the willingness of thousands of Nigerians to engage in schemes that “could help grow their money.” These individuals, unlike the sponsors of MMM and other Ponzi schemes, however, did not have to go through the stress of opening a website, neither do their patrons have to ever worry about internet connection to do “business.” Sunday Tribune gathered that the fraudsters had simply designed the template that allowed them to open a WhatsApp group, give it any catchy name and embark on an aggressive membership drive with the promise of juicy returns on investments, which is regarded as PH (Provide Help) in their circles.

“After they have got a lot of people in the groups, they tell members to Provide Help of certain amount and get double or triple of that amount. And to further make the scheme attractive, they promised such returns in 24 or 48 hours. They will tell you to indicate interest to PH by dropping your number and name and then they match you with another group member, who you are made to believe has PHed and could now Get Help (GH),” Adeolu said.

The expected investment range from N1,500 to N20,000 and anyone who has made a payment would be asked to upload the evidence on the group platform and expect repayment by others, Sunday Tribune learnt. The problem, however, is that while some of the platforms tried to fulfill that promise of repayment for some time, before they ran into troubled waters as a result of inability to get new members to pay old ones, others simply removed group members who were not in on their fraud or even delete the groups completely and go ahead to create new ones.

Once beaten, not shy!

As MMM continued to ail, without any serious sign of giving up participants’ money, which they had paid to other participants and would need new patrons to be able to get returns, the Nigerian landscape became abuzz with several other schemes with different names and promises, from outright absurd to downright incredible.

Apart from NNN, which appeared to be a Nigerian copycat of MMM, aping MMM in several ways by calling its own monetary unit “Navros” instead of MMM’s Mavros and replacing MMM’s “letter of happiness,” which is expected to be written after one has been paid, with “letter of joy,” Get Help Worldwide, CLO, Naira Propeller, Twinkas had begun to gain ground among Nigerians. But the WhatsApp platforms, given the simplicity of their operations, had quickly become the fad among patrons of the schemes, with some of them making reference to the simplicity and shortness of the time for the return on investment as major reasons they joined the groups.

“Each of these schemes either promises 100 per cent increment in 21 days or less but not below MMM’s 30 per cent. These schemes operate websites, which they expect patrons to visit and conduct their activities. But some Nigerians, apparently determined to outdo the operators who used the internet, have, however, taken the money-doubling game a step further. Now, individuals simply open a WhatsApp group, add people and broadcast the group, asking people to pay a certain amount and get double that amount not in 21 or 30 days but in 24 or 48 hours. To be a part of the scheme, one needs to register a phone number and his/her intention after which he/she will be merged with another participant, who is believed to have paid someone else earlier. Though that is not always the case,” Mr Eze Uche, who told Sunday Tribune that he had invested in most of the schemes, said.

Unfortunately, however, the simplicity of the WhatsApp Ponzi schemes have also been said to be the undoing of thousands of Nigerians who patronise them, with most of the operators described as fraudsters, who, convinced that Nigerians would fall for any promise to double investments at this moment, due to the economic situation of the country, quickly arrange their cronies in a WhatsApp group, get them to say that they had Provided Help and Got Help in promised time and thereby convince unsuspecting new patrons, who will often quickly oblige by PHing and paying people they are merged to pay.

“Most times, new entrants are merged to pay the cronies of these fraudsters or even fraudsters themselves who are often the administrators of the group. And since the venture relies on getting more members, these fraudsters continue to recruit new victims who would pay them or their cronies and not get any return in promised time,” Uche stated, saying that he had been a victim on different such platforms. He, however, told Sunday Tribune that the secret of his staying power in the line of ‘business’ was that he did not put all his eggs in one basket, “such that when I lose somewhere, I will recoup my money in another.”

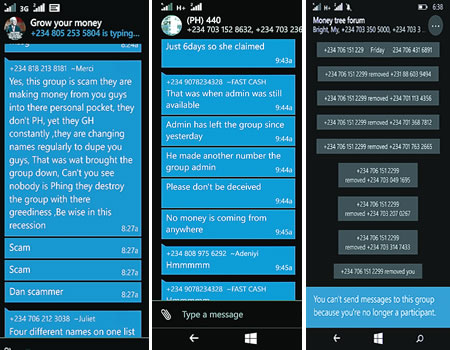

In one of such groups named “PH4KGH8K” meaning Provide Help of N4,000 and get a return of N8,000, where this reporter was a participant-observer, participants descended on their group administrator, demanding for their money after they discovered that most of them had PHed for many days without Getting Help. A particularly loud protester on the platform by the name Juliet accused the administrator of being a thief who would go to hell and before anyone could say Jack Robinson, she had been deleted by the administrator, a development that irked other patrons who rained abuses on him. He, however, managed to contain the situation, noting that he would publish a list of people who would Get Help the following morning. The morning came, but instead of the patrons to hear the good news, they found out that the group had been deleted. Attempt to call the number has remained abortive ever since. The practice often is that, whenever participants in these WhatsApp platforms get to know they had been taken for a ride and duped, the operators of the platform would often delete the group or delete members and add new ones.

This reporter joined the group Comfort Cash and had the following conversation with the group administrator with the mobile number, 090777296**:

Reporter: Please, I am a new member in the group, Comfort Cash but I am afraid to PH, because there have been instances of WhatsApp groups like this where I PHed and before I could GH the next day, I was removed from the group. I hope that if I PH, my investment is safe…

Group admin: But I believe you can observe what is going on in our platform. We are not a fraudster (sic).

Few days after, the group administrator left the group after convincing another member to take over because he would be busy. What the members didn’t know was that he had GHed multiple times and had been paid by different patrons and when he could no longer get new members to pay those who PHed, he took the easy way out by leaving a group he founded. To perfect his con, he had repeated his phone number four times on the GH list with different names, meaning that he got N4,000 each from four people instead of getting the N8,000 promised on his N4,000 investment. When confronted, he quickly exited the group he formed and made an unsuspecting member the group administrator. As participants got wind of what transpired, they began to open up on how they had been defrauded in other groups earlier.

In Grow Your Money, another of such dubious WhatsApp platforms, the administrator of the group had kept changing names on the GH list, meaning that different patrons paid the same person without suspecting.

A patron in the group, with the profile name, Merci, said: “This group is a scam; they are making money from you guys. They don’t Provide Help yet they Get Help constantly. They are changing names regularly to dupe new guys. Be wise in recession…”

Across several of these WhatsApp groups, the promises are similar and so are the frustrations; provide help and get a return on investment that doubles or triples your money is the bait but the end of result had always been that some patrons would lose out.

Speaking with Sunday Tribune, an insurance broker, Mr Suleiman Akanni, said as long as Nigerians engaged in money-doubling schemes, they were liable to always lose their money, saying that they should instead consider joining cooperative societies or even explore the opportunities in insurance brokerage.

He said: “The truth with all these Ponzi schemes is that some people will always cry in the end. Because the schemes depend on continuous increase in the number of patrons, any moment new members do not join, the last set of people who PHed and paid will lose out.”

‘Recession pushed us to Ponzi schemes’

Adeolu, however, maintained that people had begun to engage in several money-doubling schemes to beat the harsh economic reality in the country, querying why there had been a proliferation of the schemes at the exact period when Nigerians had become frustrated and hopeless. He decried the fact that fellow Nigerians were, however, doing their countrymen in despite the fact that “we are all facing the same hardships.

“Some individuals set out from the very beginning to dupe people and this is not good. I have gained a lot from the schemes and I have also lost and I can say that many Nigerians would have been more frustrated if not for these schemes,” he said. But when asked if he had learnt his lessons, he said: “I no longer join the WhatsApp platforms, I now do NNN and CLO, those ones are still paying for now.”

Samson Dike, who was also a participant in one of the WhatsApp groups, informed Sunday Tribune that he had been patronising most of the schemes and that he had been losing and gaining, noting that that the schemes would not have been popular if the government had not failed in its duties of providing jobs and ensuring that life is not difficult. He noted that the economic recession in the country aided the patronage of the Ponzi schemes and that as long as things remained the way they were, Nigerians would continue to seek avenues to increase their incomes.

Don’t engage in such schemes —EFCC

But the Economic and Financial Crimes Commission (EFCC) has reiterated its warning to Nigerians not to engage in Ponzi schemes, noting that such decision would always have a dire consequence. According to the commission’s spokesman, Wilson Uwujaren, while speaking with Sunday Tribune, on Saturday, the commission could not monitor the activities of all the fraudulent schemes, which had been increasing, thus Nigerians needed to protect their resources by not engaging in inappropriate schemes.

Uwujaren maintained that the commission had, earlier, warned Nigerians not to engage in MMM, a warning which he said turned out to be consequential, as Nigerians had been nursing their wounds as result of what became of the scheme.

Nigerians are not strange to money-doubling schemes, with past experiences abounding about such schemes, which always ended up badly, leaving thousands of Nigerians in bad positions after a few months of jolly-ride. It would be recalled that similar schemes in 2005/2006 popularly known as “Wonder Banks,” caused huge losses and agony to Nigerians following the crash of their operations. With the losses always following serious warnings from government agencies, the questions are why are Nigerians always falling for fresh gimmicks any time new Ponzi schemes come up? And will Nigerians ever learn from the past?

WATCH TOP VIDEOS FROM NIGERIAN TRIBUNE TV

- Let’s Talk About SELF-AWARENESS

- Is Your Confidence Mistaken for Pride? Let’s talk about it

- Is Etiquette About Perfection…Or Just Not Being Rude?

- Top Psychologist Reveal 3 Signs You’re Struggling With Imposter Syndrome

- Do You Pick Up Work-Related Calls at Midnight or Never? Let’s Talk About Boundaries